Jason Milionis

12 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

FLAIR: A Metric for Liquidity Provider Competitiveness in Automated Market Makers

This paper aims to enhance the understanding of liquidity provider (LP) returns in automated market makers (AMMs). LPs face market risk as well as adverse selection due to risky asset holdings in th...

Automated Market Making and Arbitrage Profits in the Presence of Fees

We consider the impact of trading fees on the profits of arbitrageurs trading against an automated marker marker (AMM) or, equivalently, on the adverse selection incurred by liquidity providers due ...

A Myersonian Framework for Optimal Liquidity Provision in Automated Market Makers

In decentralized finance ("DeFi"), automated market makers (AMMs) enable traders to programmatically exchange one asset for another. Such trades are enabled by the assets deposited by liquidity prov...

Complexity-Approximation Trade-offs in Exchange Mechanisms: AMMs vs. LOBs

This paper presents a general framework for the design and analysis of exchange mechanisms between two assets that unifies and enables comparisons between the two dominant paradigms for exchange, co...

A Framework for Single-Item NFT Auction Mechanism Design

Lately, Non-Fungible Tokens (NFTs), i.e., uniquely discernible assets on a blockchain, have skyrocketed in popularity by addressing a broad audience. However, the typical NFT auctioning procedures a...

Automated Market Making and Loss-Versus-Rebalancing

We consider the market microstructure of automated market makers (AMMs) from the perspective of liquidity providers (LPs). Our central contribution is a ``Black-Scholes formula for AMMs''. We identi...

Nash, Conley, and Computation: Impossibility and Incompleteness in Game Dynamics

Under what conditions do the behaviors of players, who play a game repeatedly, converge to a Nash equilibrium? If one assumes that the players' behavior is a discrete-time or continuous-time rule wh...

Differentially Private Regression with Unbounded Covariates

We provide computationally efficient, differentially private algorithms for the classical regression settings of Least Squares Fitting, Binary Regression and Linear Regression with unbounded covaria...

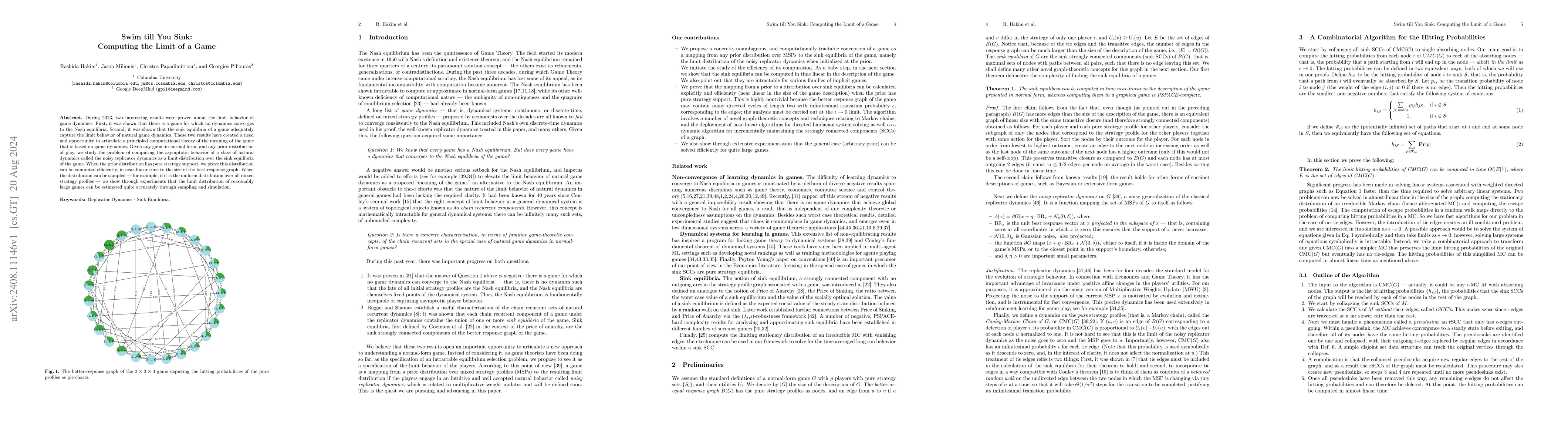

Swim till You Sink: Computing the Limit of a Game

During 2023, two interesting results were proven about the limit behavior of game dynamics: First, it was shown that there is a game for which no dynamics converges to the Nash equilibria. Second, it ...

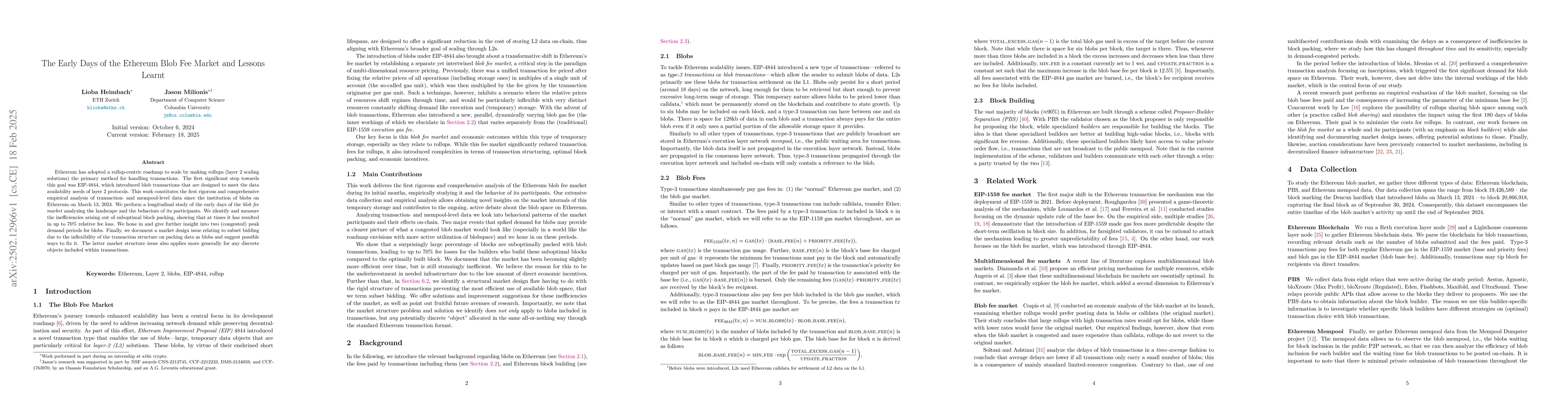

The Early Days of the Ethereum Blob Fee Market and Lessons Learnt

Ethereum has adopted a rollup-centric roadmap to scale by making rollups (layer 2 scaling solutions) the primary method for handling transactions. The first significant step towards this goal was EIP-...

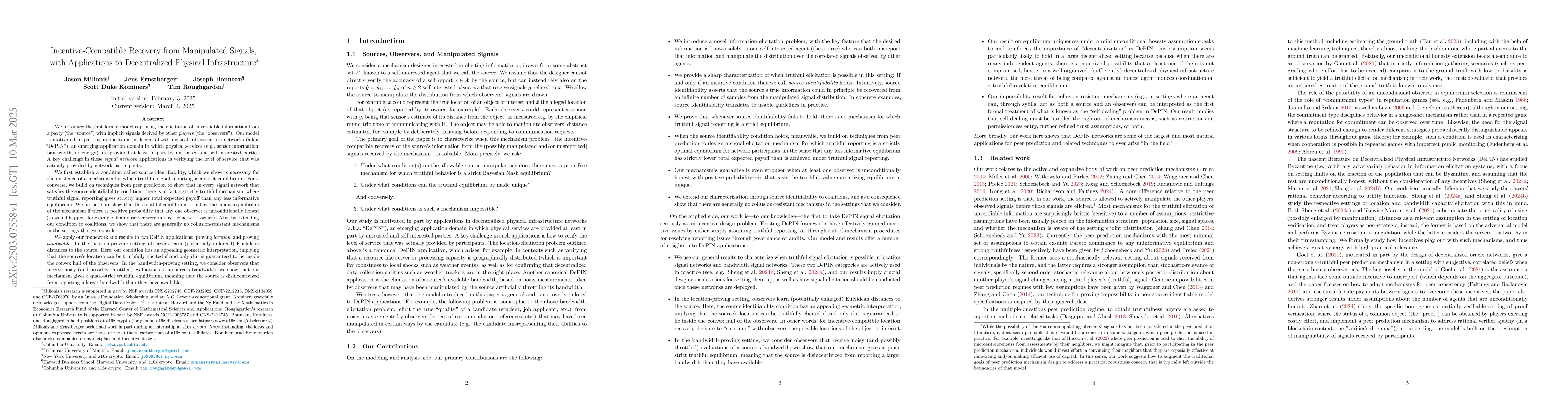

Incentive-Compatible Recovery from Manipulated Signals, with Applications to Decentralized Physical Infrastructure

We introduce the first formal model capturing the elicitation of unverifiable information from a party (the "source") with implicit signals derived by other players (the "observers"). Our model is mot...

Optimal Fees for Liquidity Provision in Automated Market Makers

Passive liquidity providers (LPs) in automated market makers (AMMs) face losses due to adverse selection (LVR), which static trading fees often fail to offset in practice. We study the key determinant...