Summary

We consider the impact of trading fees on the profits of arbitrageurs trading against an automated marker marker (AMM) or, equivalently, on the adverse selection incurred by liquidity providers due to arbitrage. We extend the model of Milionis et al. [2022] for a general class of two asset AMMs to both introduce fees and discrete Poisson block generation times. In our setting, we are able to compute the expected instantaneous rate of arbitrage profit in closed form. When the fees are low, in the fast block asymptotic regime, the impact of fees takes a particularly simple form: fees simply scale down arbitrage profits by the fraction of time that an arriving arbitrageur finds a profitable trade.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

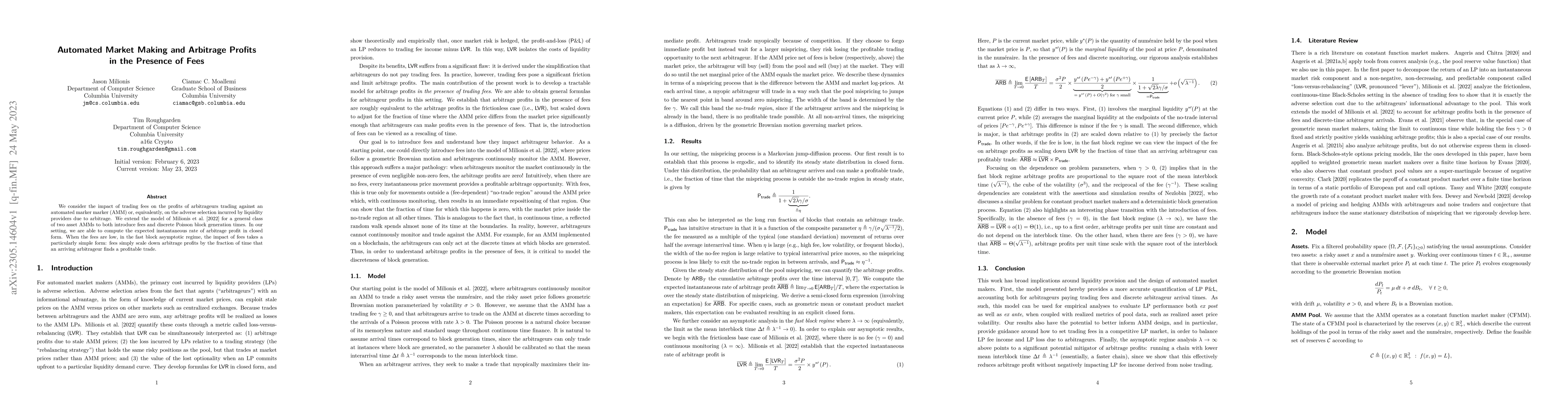

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersAn arbitrage driven price dynamics of Automated Market Makers in the presence of fees

Joseph Najnudel, Kazutoshi Yamazaki, Shen-Ning Tung et al.

Optimal Dynamic Fees in Automated Market Makers

Leandro Sánchez-Betancourt, Martin Herdegen, Leonardo Baggiani

QLAMMP: A Q-Learning Agent for Optimizing Fees on Automated Market Making Protocols

Bhaskar Krishnamachari, Dev Churiwala

| Title | Authors | Year | Actions |

|---|

Comments (0)