Summary

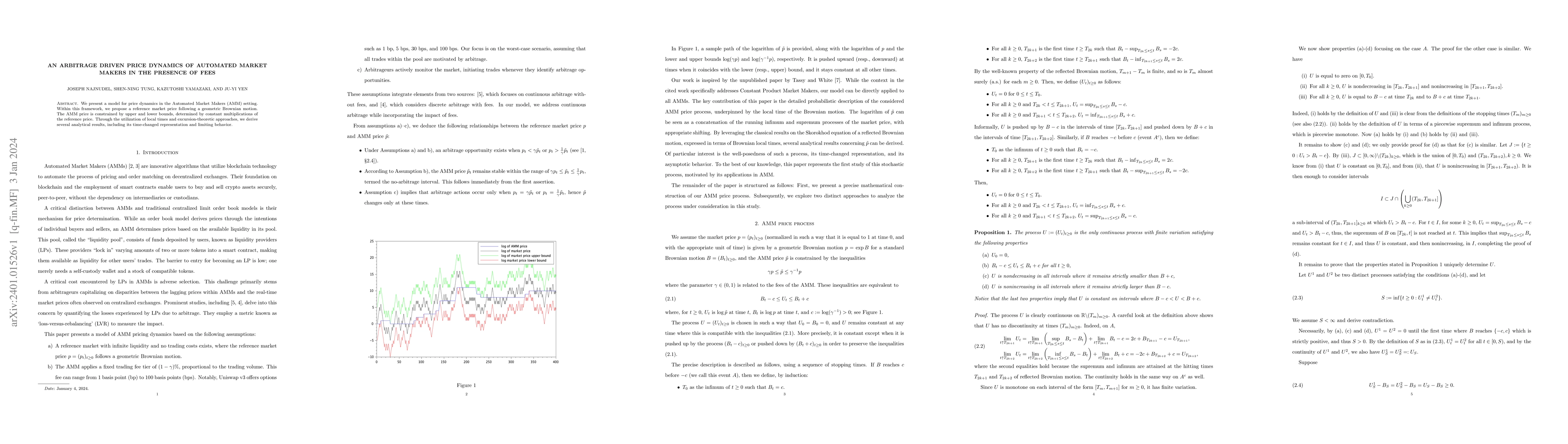

We present a model for price dynamics in the Automated Market Makers (AMM) setting. Within this framework, we propose a reference market price following a geometric Brownian motion. The AMM price is constrained by upper and lower bounds, determined by constant multiplications of the reference price. Through the utilization of local times and excursion-theoretic approaches, we derive several analytical results, including its time-changed representation and limiting behavior.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal Dynamic Fees in Automated Market Makers

Leandro Sánchez-Betancourt, Martin Herdegen, Leonardo Baggiani

Automated Market Making and Arbitrage Profits in the Presence of Fees

Tim Roughgarden, Ciamac C. Moallemi, Jason Milionis

Quantifying Arbitrage in Automated Market Makers: An Empirical Study of Ethereum ZK Rollups

Benjamin Livshits, Krzysztof Gogol, Johnnatan Messias et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)