Summary

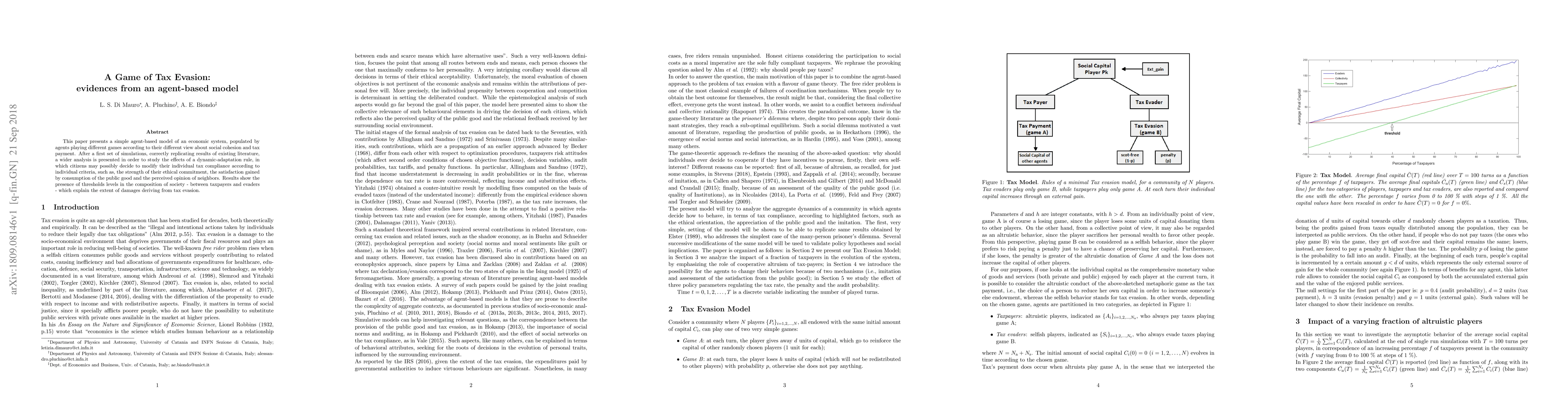

This paper presents a simple agent-based model of an economic system, populated by agents playing different games according to their different view about social cohesion and tax payment. After a first set of simulations, correctly replicating results of existing literature, a wider analysis is presented in order to study the effects of a dynamic-adaptation rule, in which citizens may possibly decide to modify their individual tax compliance according to individual criteria, such as, the strength of their ethical commitment, the satisfaction gained by consumption of the public good and the perceived opinion of neighbors. Results show the presence of thresholds levels in the composition of society - between taxpayers and evaders - which explain the extent of damages deriving from tax evasion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)