Summary

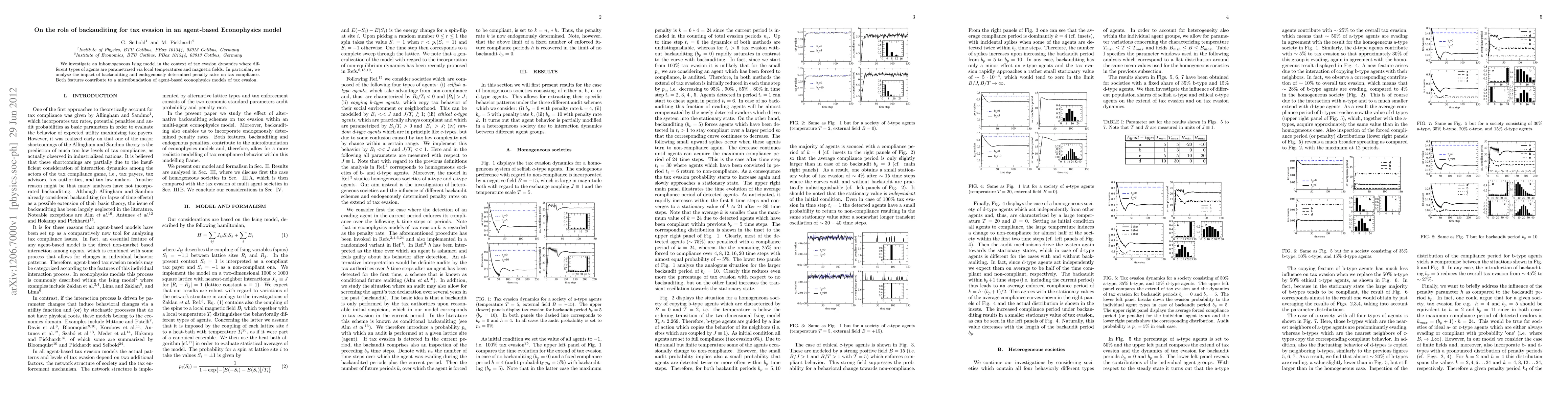

We investigate an inhomogeneous Ising model in the context of tax evasion dynamics where different types of agents are parametrized via local temperatures and magnetic fields. In particular, we analyse the impact of backauditing and endogenously determined penalty rates on tax compliance. Both features contribute to a microfoundation of agent-based econophysics models of tax evasion.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)