Summary

Interaction strategies for reward in competitive environments are significantly influenced by the nature and extent of available information. In financial markets, particularly foreign exchange (forex), traders operate independently with limited information, often yielding highly unpredictable outcomes. This study introduces a game-theoretic framework modeling the market as a strategically active participant, rather than a neutral entity, within a stochastic, imperfect information setting. In this model, the market alternates sequentially with new traders, each trader having limited visibility of the market's moves, while the market observes and counteracts each trader strategy. Through a series of simulations, we show that this information asymmetry enables the market to consistently outperform traders on aggregate. This outcome suggests that real-world forex environments may inherently favor market structures with greater informational advantage, challenging the perception of a level playing field. The model provides a basis for simulating skewed information environments, highlighting how strategic imbalances contribute to trader losses. Further optimization of the intelligent market scoring and refined simulations of trader-market interactions can enhance predictive analytics for forex, offering a robust tool for market behavior analysis.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

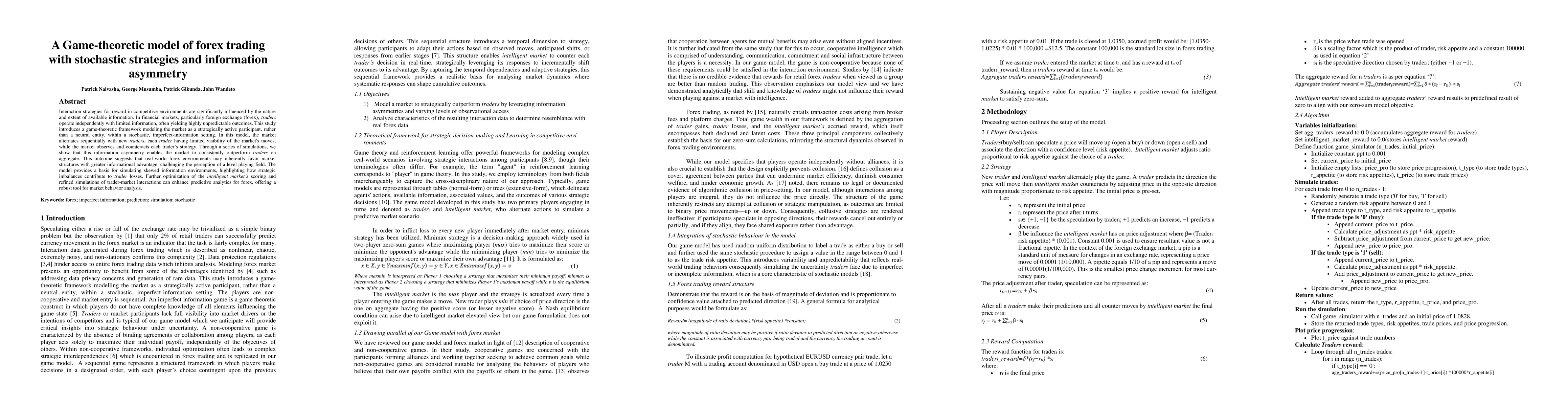

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantum Advantage in Trading: A Game-Theoretic Approach

Norbert M. Linke, Dror Baron, Faisal Shah Khan et al.

Forex Trading Robot Using Fuzzy Logic

Alireza Nasiri, Mustafa Shabani, Hassan Nafardi

No citations found for this paper.

Comments (0)