Summary

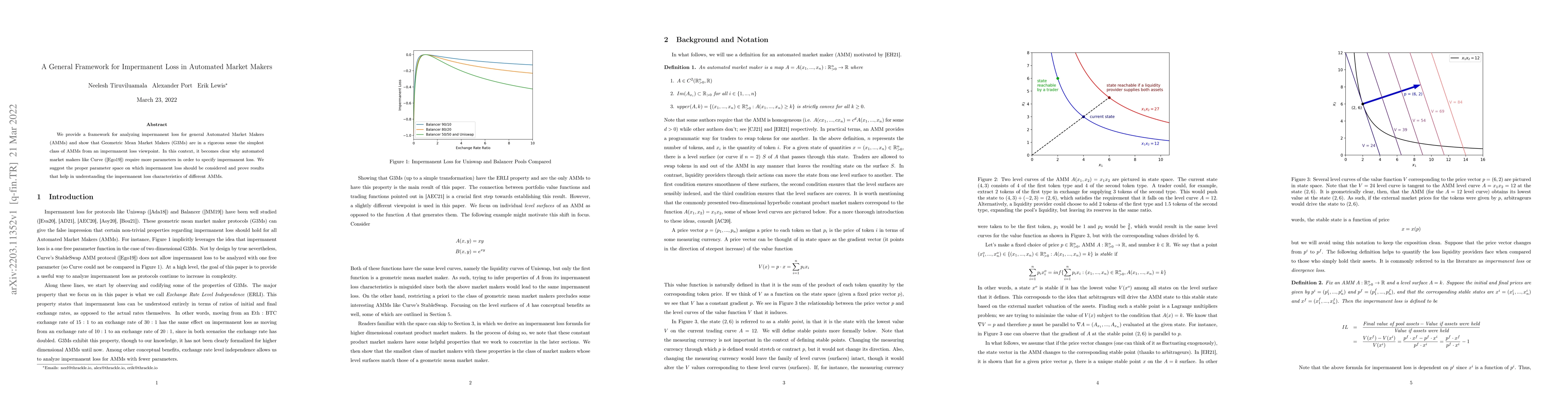

We provide a framework for analyzing impermanent loss for general Automated Market Makers (AMMs) and show that Geometric Mean Market Makers (G3Ms) are in a rigorous sense the simplest class of AMMs from an impermanent loss viewpoint. In this context, it becomes clear why automated market makers like Curve ([Ego19]) require more parameters in order to specify impermanent loss. We suggest the proper parameter space on which impermanent loss should be considered and prove results that help in understanding the impermanent loss characteristics of different AMMs.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel-free Hedging of Impermanent Loss in Geometric Mean Market Makers

Masaaki Fukasawa, Basile Maire, Marcus Wunsch

Generalizing Impermanent Loss on Decentralized Exchanges with Constant Function Market Makers

Danilo Mandic, Peter Yatsyshin, Rohan Tangri et al.

Delta Hedging Liquidity Positions on Automated Market Makers

Xi Chen, Adam Khakhar

| Title | Authors | Year | Actions |

|---|

Comments (0)