Summary

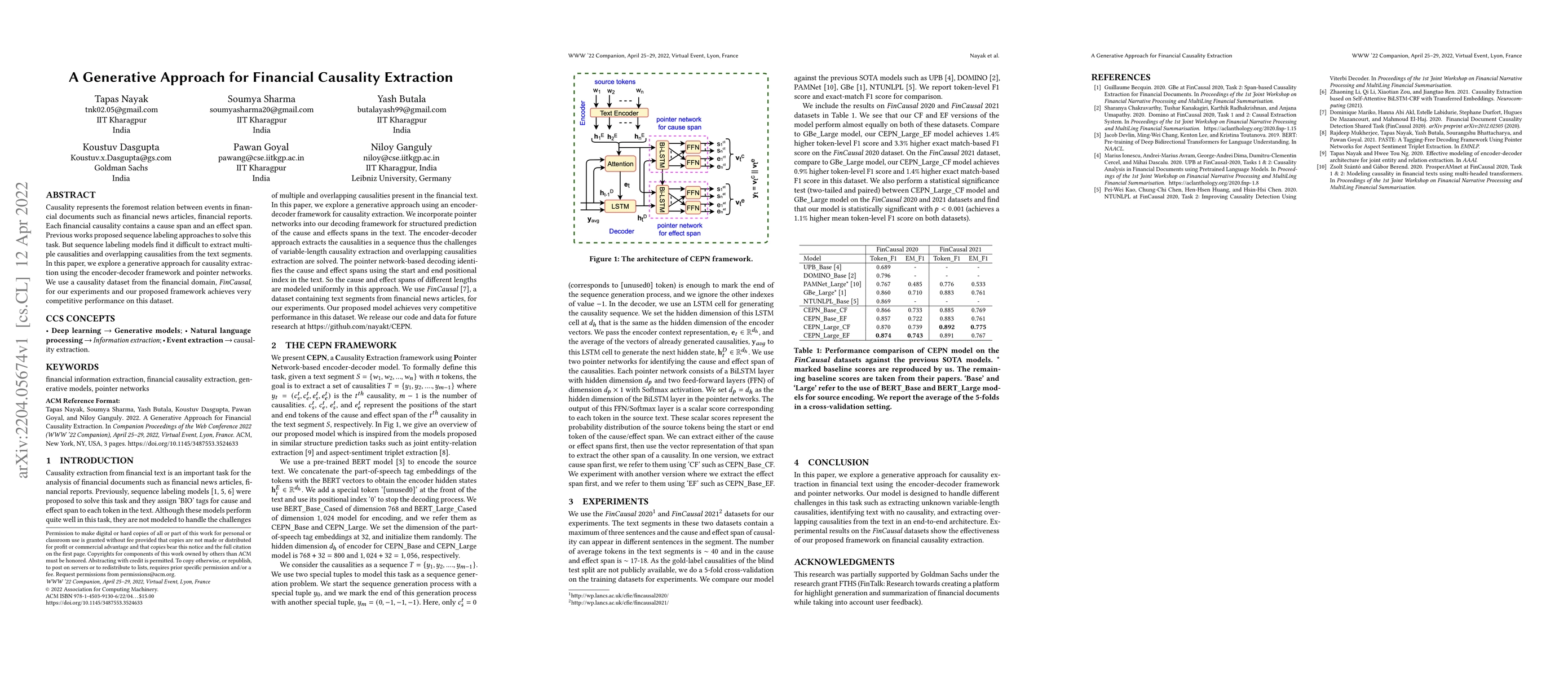

Causality represents the foremost relation between events in financial documents such as financial news articles, financial reports. Each financial causality contains a cause span and an effect span. Previous works proposed sequence labeling approaches to solve this task. But sequence labeling models find it difficult to extract multiple causalities and overlapping causalities from the text segments. In this paper, we explore a generative approach for causality extraction using the encoder-decoder framework and pointer networks. We use a causality dataset from the financial domain, \textit{FinCausal}, for our experiments and our proposed framework achieves very competitive performance on this dataset.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHarnessing Generative LLMs for Enhanced Financial Event Entity Extraction Performance

Ji-jun Park, Soo-joon Choi

Linear and nonlinear causality in financial markets

Christoph Räth, Haochun Ma, Davide Prosperino et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)