Summary

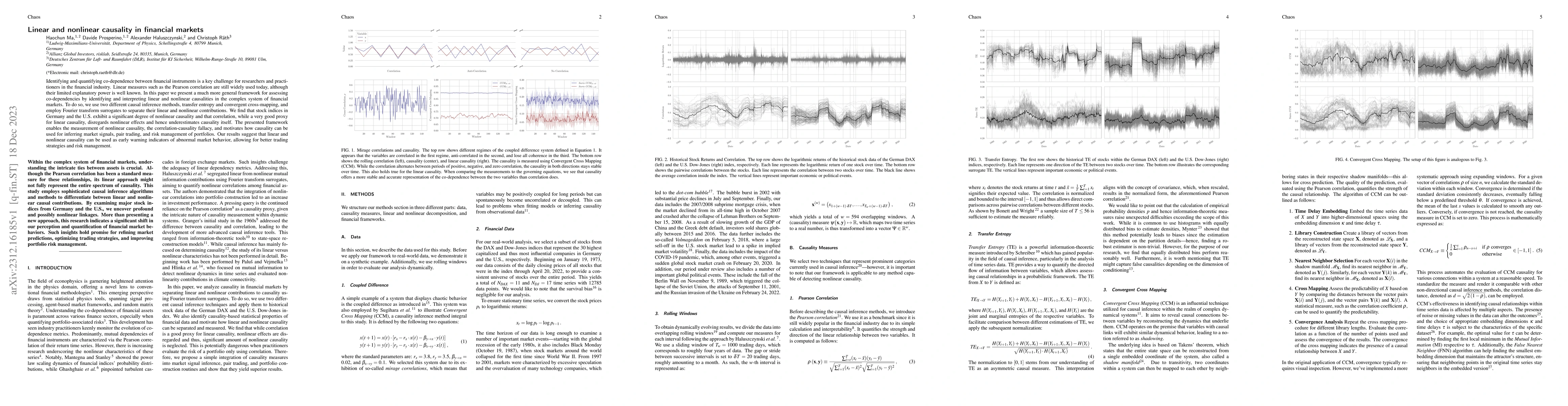

Identifying and quantifying co-dependence between financial instruments is a key challenge for researchers and practitioners in the financial industry. Linear measures such as the Pearson correlation are still widely used today, although their limited explanatory power is well known. In this paper we present a much more general framework for assessing co-dependencies by identifying and interpreting linear and nonlinear causalities in the complex system of financial markets. To do so, we use two different causal inference methods, transfer entropy and convergent cross-mapping, and employ Fourier transform surrogates to separate their linear and nonlinear contributions. We find that stock indices in Germany and the U.S. exhibit a significant degree of nonlinear causality and that correlation, while a very good proxy for linear causality, disregards nonlinear effects and hence underestimates causality itself. The presented framework enables the measurement of nonlinear causality, the correlation-causality fallacy, and motivates how causality can be used for inferring market signals, pair trading, and risk management of portfolios. Our results suggest that linear and nonlinear causality can be used as early warning indicators of abnormal market behavior, allowing for better trading strategies and risk management.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausality between investor sentiment and the shares return on the Moroccan and Tunisian financial markets

Chniguir Mounira, Henchiri Jamel Eddine

| Title | Authors | Year | Actions |

|---|

Comments (0)