Summary

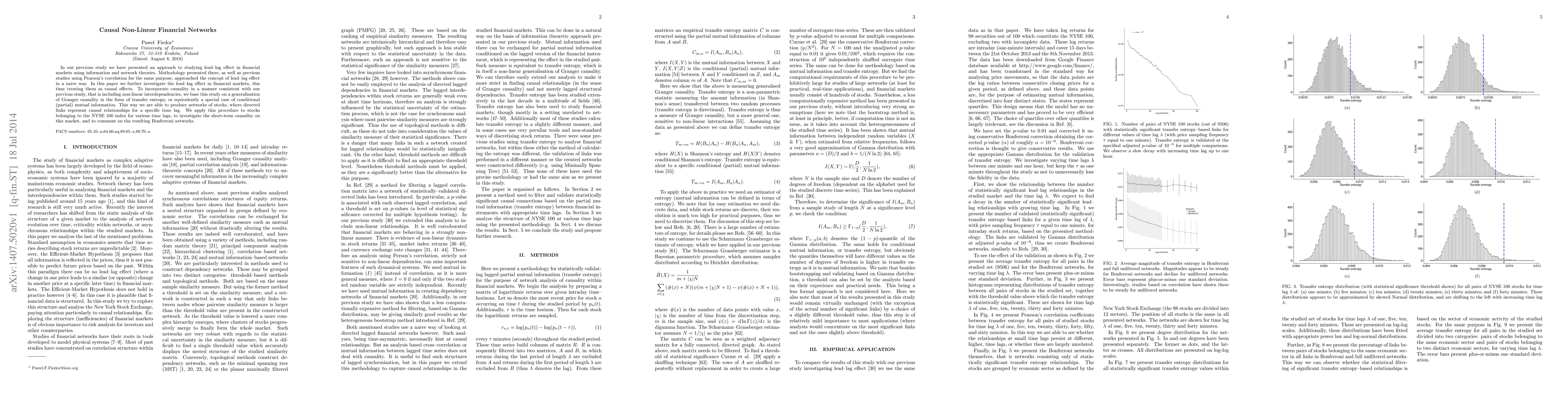

In our previous study we have presented an approach to studying lead--lag effect in financial markets using information and network theories. Methodology presented there, as well as previous studies using Pearson's correlation for the same purpose, approached the concept of lead--lag effect in a naive way. In this paper we further investigate the lead--lag effect in financial markets, this time treating them as causal effects. To incorporate causality in a manner consistent with our previous study, that is including non-linear interdependencies, we base this study on a generalisation of Granger causality in the form of transfer entropy, or equivalently a special case of conditional (partial) mutual information. This way we are able to produce networks of stocks, where directed links represent causal relationships for a specific time lag. We apply this procedure to stocks belonging to the NYSE 100 index for various time lags, to investigate the short-term causality on this market, and to comment on the resulting Bonferroni networks.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersEnhancing Causal Discovery in Financial Networks with Piecewise Quantile Regression

Matthew Roughan, Lewis Mitchell, Cameron Cornell

No citations found for this paper.

Comments (0)