Summary

Financial networks can be constructed using statistical dependencies found within the price series of speculative assets. Across the various methods used to infer these networks, there is a general reliance on predictive modelling to capture cross-correlation effects. These methods usually model the flow of mean-response information, or the propagation of volatility and risk within the market. Such techniques, though insightful, don't fully capture the broader distribution-level causality that is possible within speculative markets. This paper introduces a novel approach, combining quantile regression with a piecewise linear embedding scheme - allowing us to construct causality networks that identify the complex tail interactions inherent to financial markets. Applying this method to 260 cryptocurrency return series, we uncover significant tail-tail causal effects and substantial causal asymmetry. We identify a propensity for coins to be self-influencing, with comparatively sparse cross variable effects. Assessing all link types in conjunction, Bitcoin stands out as the primary influencer - a nuance that is missed in conventional linear mean-response analyses. Our findings introduce a comprehensive framework for modelling distributional causality, paving the way towards more holistic representations of causality in financial markets.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

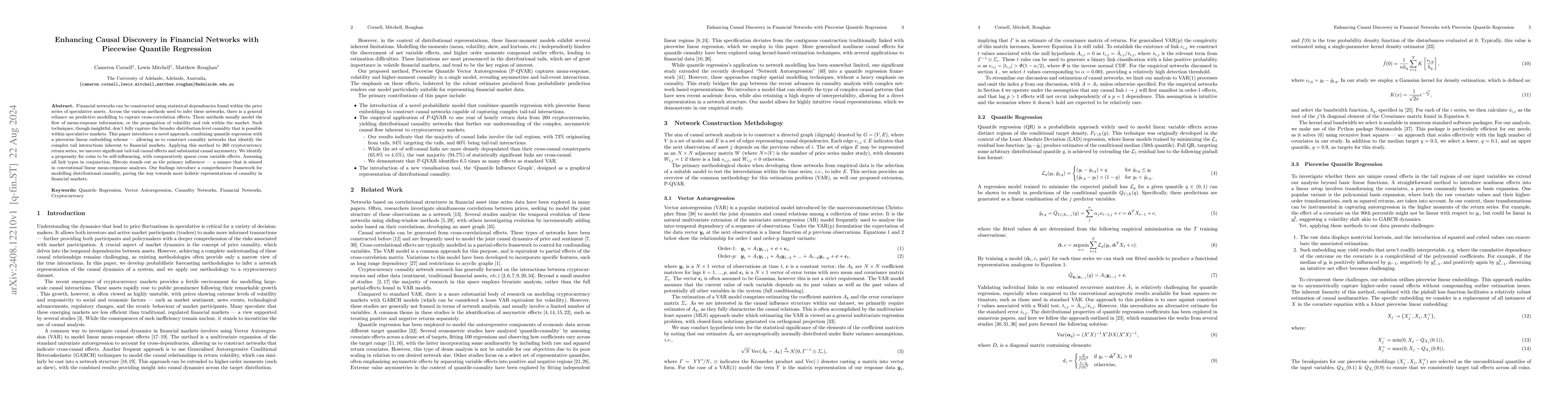

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersCausal Discovery via Quantile Partial Effect

Dehui Du, Yikang Chen, Xingzhe Sun

Exploring Financial Networks Using Quantile Regression and Granger Causality

Sumanta Basu, Diganta Mukherjee, Samriddha Lahiry et al.

No citations found for this paper.

Comments (0)