Summary

In the post-crisis era, financial regulators and policymakers are increasingly interested in data-driven tools to measure systemic risk and to identify systemically important firms. Granger Causality (GC) based techniques to build networks among financial firms using time series of their stock returns have received significant attention in recent years. Existing GC network methods model conditional means, and do not distinguish between connectivity in lower and upper tails of the return distribution - an aspect crucial for systemic risk analysis. We propose statistical methods that measure connectivity in the financial sector using system-wide tail-based analysis and is able to distinguish between connectivity in lower and upper tails of the return distribution. This is achieved using bivariate and multivariate GC analysis based on regular and Lasso penalized quantile regressions, an approach we call quantile Granger causality (QGC). By considering centrality measures of these financial networks, we can assess the build-up of systemic risk and identify risk propagation channels. We provide an asymptotic theory of QGC estimators under a quantile vector autoregressive model, and show its benefit over regular GC analysis on simulated data. We apply our method to the monthly stock returns of large U.S. firms and demonstrate that lower tail based networks can detect systemically risky periods in historical data with higher accuracy than mean-based networks. In a similar analysis of large Indian banks, we find that upper and lower tail networks convey different information and have the potential to distinguish between periods of high connectivity that are governed by positive vs negative news in the market.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

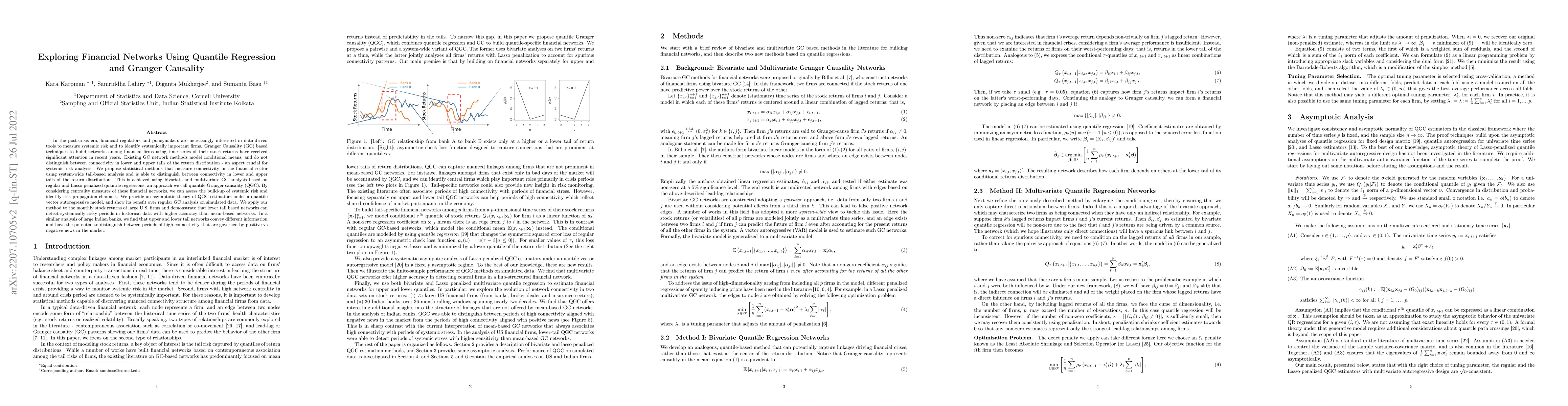

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersQuantile Granger Causality in the Presence of Instability

Alexander Mayer, Dominik Wied, Victor Troster

Nonlinear Granger Causality using Kernel Ridge Regression

Wojciech "Victor" Fulmyk

Granger Causality using Neural Networks

Samuel Horvath, Hernando Ombao, Malik Shahid Sultan

| Title | Authors | Year | Actions |

|---|

Comments (0)