Summary

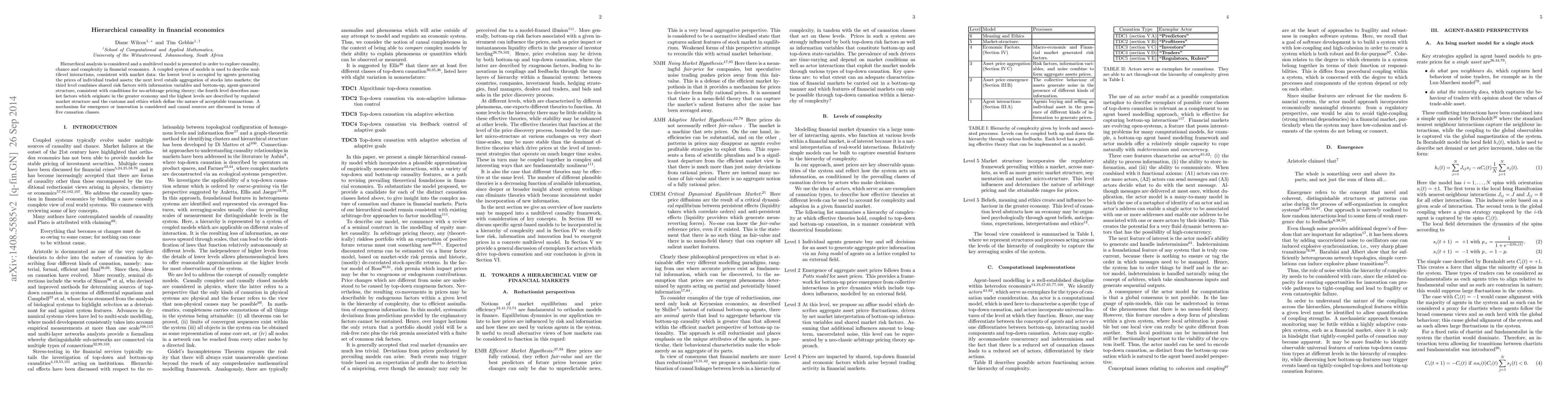

Hierarchical analysis is considered and a multilevel model is presented in order to explore causality, chance and complexity in financial economics. A coupled system of models is used to describe multilevel interactions, consistent with market data: the lowest level is occupied by agents generating the prices of individual traded assets; the next level entails aggregation of stocks into markets; the third level combines shared risk factors with information variables and bottom-up, agent-generated structure, consistent with conditions for no-arbitrage pricing theory; the fourth level describes market factors which originate in the greater economy and the highest levels are described by regulated market structure and the customs and ethics which define the nature of acceptable transactions. A mechanism for emergence or innovation is considered and causal sources are discussed in terms of five causation classes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersLinear and nonlinear causality in financial markets

Christoph Räth, Haochun Ma, Davide Prosperino et al.

A Generative Approach for Financial Causality Extraction

Pawan Goyal, Niloy Ganguly, Koustuv Dasgupta et al.

A Look at Financial Dependencies by Means of Econophysics and Financial Economics

T. Di Matteo, M. Raddant

| Title | Authors | Year | Actions |

|---|

Comments (0)