Authors

Summary

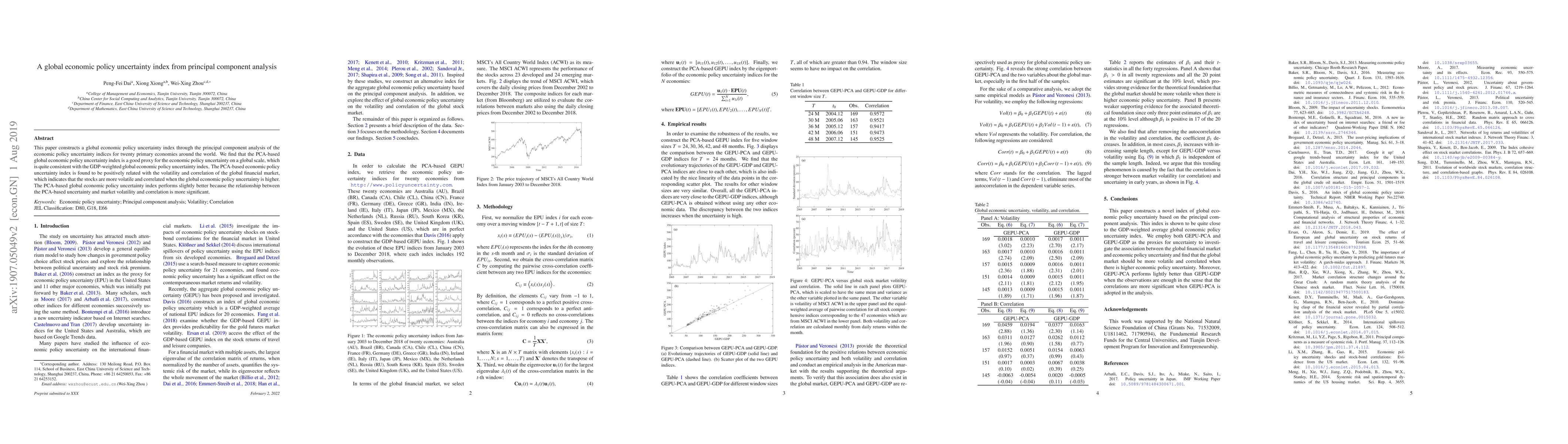

This paper constructs a global economic policy uncertainty index through the principal component analysis of the economic policy uncertainty indices for twenty primary economies around the world. We find that the PCA-based global economic policy uncertainty index is a good proxy for the economic policy uncertainty on a global scale, which is quite consistent with the GDP-weighted global economic policy uncertainty index. The PCA-based economic policy uncertainty index is found to be positively related with the volatility and correlation of the global financial market, which indicates that the stocks are more volatile and correlated when the global economic policy uncertainty is higher. The PCA-based global economic policy uncertainty index performs slightly better because the relationship between the PCA-based uncertainty and market volatility and correlation is more significant.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)