Authors

Summary

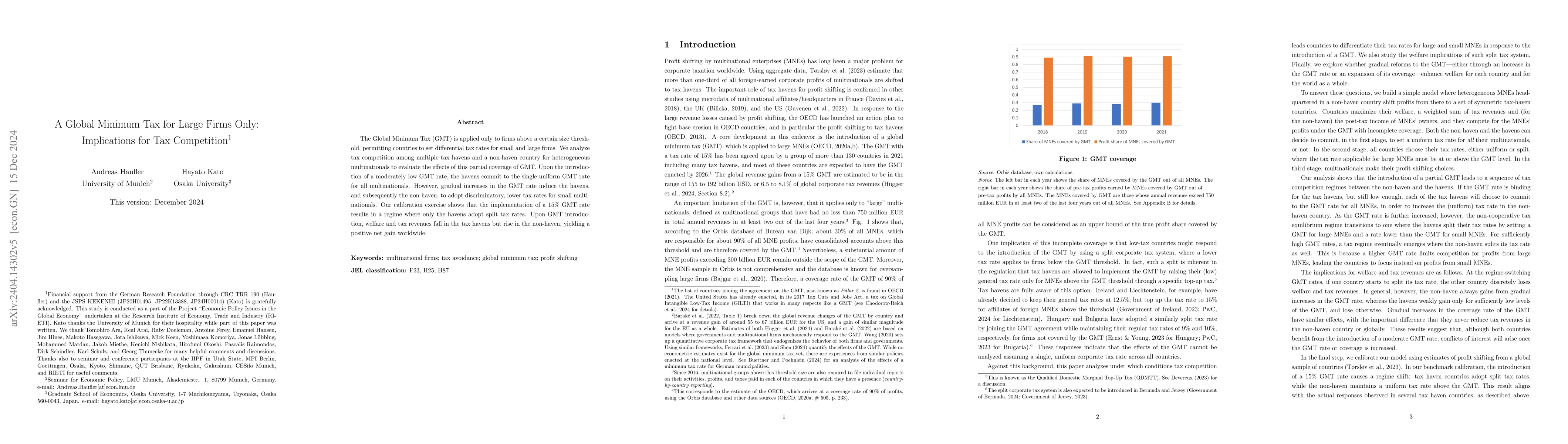

The Global Minimum Tax (GMT) is applied only to firms above a certain size threshold. We set up a simple model of tax competition and profit shifting by heterogeneous multinational firms to evaluate the effects of this partial coverage of the GMT. A non-haven and a haven country are bound by the GMT rate for large multinationals, but can set tax rates for firms below the threshold non-cooperatively. We show that the introduction of the GMT with a moderate tax rate increases tax revenues in both the non-haven and the haven countries. Gradual increases in the GMT rate, however, trigger a sudden change in the tax competition equilibrium from a uniform to a split corporate tax rate, at which tax revenues in the non-haven country decline. In contrast, gradual increases in the coverage of the GMT never harm the non-haven country. We also discuss the quantitative effects of introducing a $15\%$ GMT rate in a calibrated version of our model.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)