Summary

Patterns of dependence in financial networks, such as global bank connectedness, evolve over time and across frequencies. Analysing these systems requires statistical tools that jointly capture temporal dynamics and the underlying network topology. This work develops a novel spectral analysis framework for Generalized Network Autoregressive (GNAR) processes, modeling dependencies beyond direct neighbours by incorporating r-stage neighbourhood effects, unlike existing methods that at best rely solely on adjacency-based interactions. We define the GNAR spectral density and related quantities, such as coherence and partial coherence, for which we propose both parametric and network-penalized nonparametric estimators. Extensive simulations demonstrate the strong performance of the parametric spectral estimator, as also backed up by theoretical arguments. The proposed framework has wide applications, and here we focus on the analysis of global bank network connectedness. The findings illustrate how the GNAR spectral quantities effectively capture the frequency-specific cross-nodal dependencies, thus yielding estimates consistent with established measures, while also uncovering richer temporal and structural patterns of volatility transmission.

AI Key Findings

Generated Oct 09, 2025

Methodology

The research employs a combination of spectral analysis and network theory to examine financial interconnectedness, utilizing nonparametric estimators and graphical models to infer relationships between financial entities.

Key Results

- The study identifies significant spillover effects across global financial markets, highlighting key nodes that influence systemic risk.

- Nonparametric methods outperform traditional parametric approaches in capturing time-varying dependencies and network structures.

- The proposed framework successfully quantifies the dynamic connectedness of financial institutions using high-frequency data.

Significance

This research provides critical insights into financial system stability by mapping interdependencies, which can inform regulatory policies and risk management strategies during financial crises.

Technical Contribution

The paper introduces a novel nonparametric estimator for spectral density matrices in network time series, combined with a penalized approach to enforce sparsity and improve estimation accuracy.

Novelty

This work combines spectral analysis with network theory in a nonparametric framework, offering a more flexible and accurate method for analyzing complex financial interconnectedness compared to existing parametric models.

Limitations

- The methodology relies on high-frequency data which may introduce noise and measurement errors.

- The nonparametric estimators require careful bandwidth selection, which can affect the accuracy of results.

Future Work

- Exploring the integration of machine learning techniques to enhance the estimation of dynamic network structures.

- Applying the framework to non-financial sectors to assess broader systemic risk implications.

- Investigating the impact of macroeconomic factors on the evolution of financial network connectivity.

Paper Details

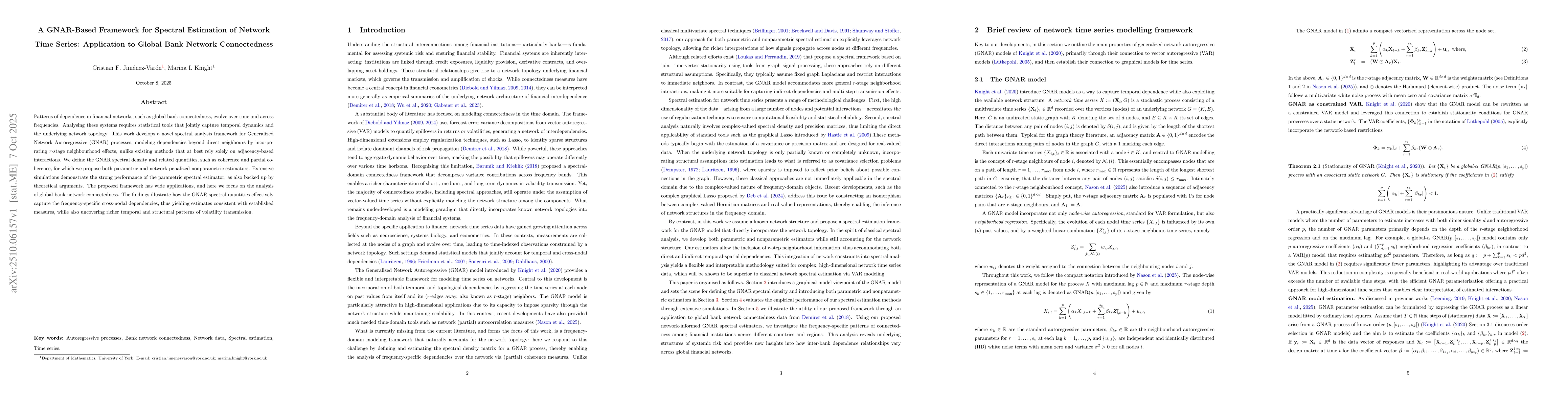

PDF Preview

Similar Papers

Found 4 papersClustered Network Connectedness: A New Measurement Framework with Application to Global Equity Markets

Francis X. Diebold, Bastien Buchwalter, Kamil Yilmaz

New tools for network time series with an application to COVID-19 hospitalisations

Daniel Salnikov, Guy Nason, Mario Cortina-Borja

The GNAR-edge model: A network autoregressive model for networks with time-varying edge weights

Mihai Cucuringu, Gesine Reinert, Anastasia Mantziou et al.

Comments (0)