Summary

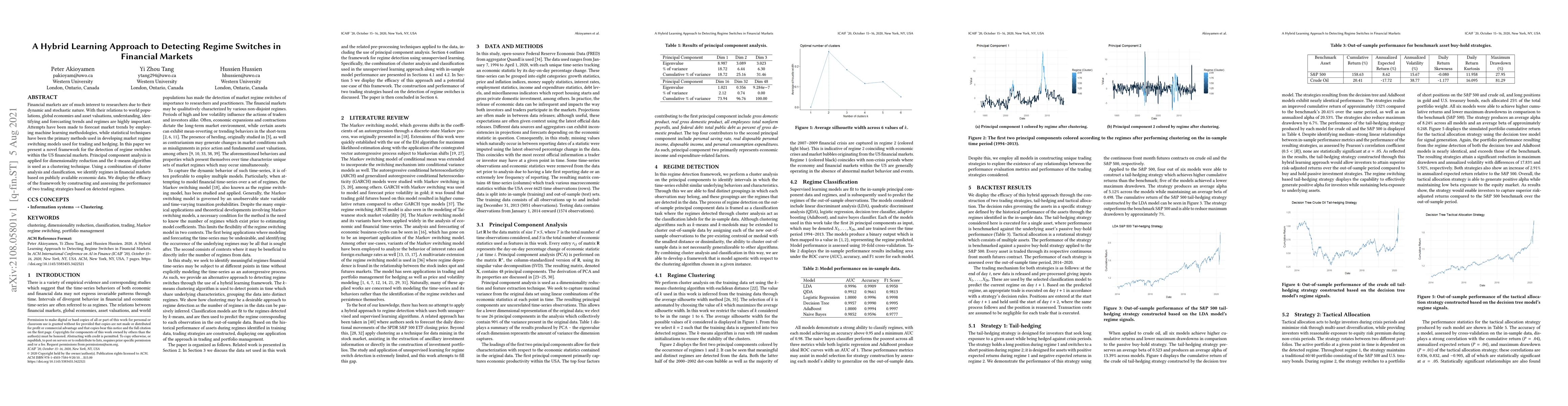

Financial markets are of much interest to researchers due to their dynamic and stochastic nature. With their relations to world populations, global economies and asset valuations, understanding, identifying and forecasting trends and regimes are highly important. Attempts have been made to forecast market trends by employing machine learning methodologies, while statistical techniques have been the primary methods used in developing market regime switching models used for trading and hedging. In this paper we present a novel framework for the detection of regime switches within the US financial markets. Principal component analysis is applied for dimensionality reduction and the k-means algorithm is used as a clustering technique. Using a combination of cluster analysis and classification, we identify regimes in financial markets based on publicly available economic data. We display the efficacy of the framework by constructing and assessing the performance of two trading strategies based on detected regimes.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDual-CLVSA: a Novel Deep Learning Approach to Predict Financial Markets with Sentiment Measurements

Yu Cao, Jia Wang, Benyuan Liu et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)