Summary

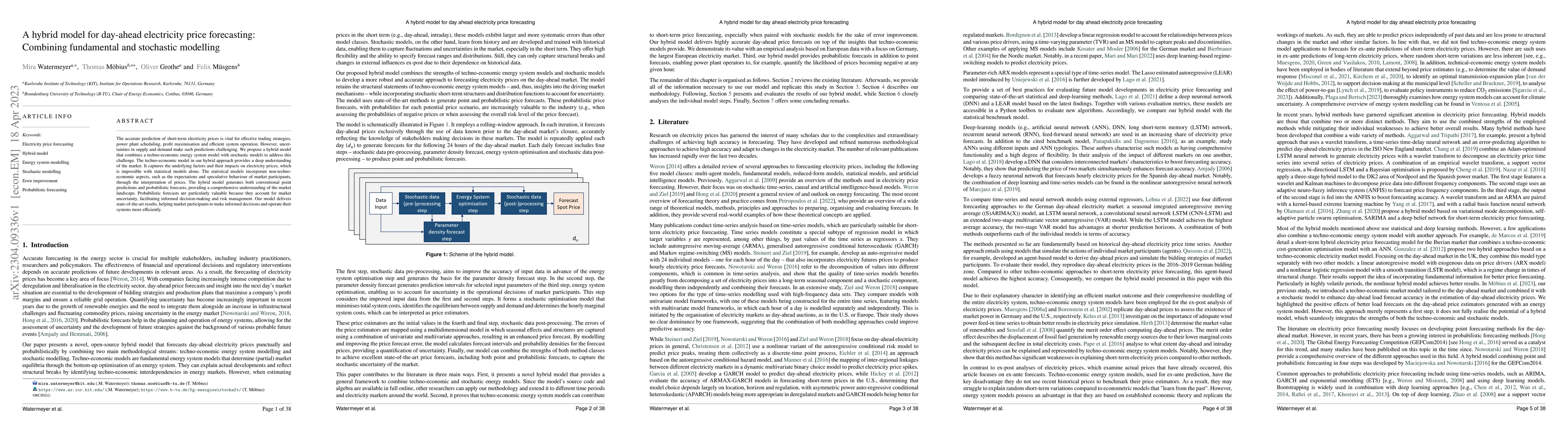

The accurate prediction of short-term electricity prices is vital for effective trading strategies, power plant scheduling, profit maximisation and efficient system operation. However, uncertainties in supply and demand make such predictions challenging. We propose a hybrid model that combines a techno-economic energy system model with stochastic models to address this challenge. The techno-economic model in our hybrid approach provides a deep understanding of the market. It captures the underlying factors and their impacts on electricity prices, which is impossible with statistical models alone. The statistical models incorporate non-techno-economic aspects, such as the expectations and speculative behaviour of market participants, through the interpretation of prices. The hybrid model generates both conventional point predictions and probabilistic forecasts, providing a comprehensive understanding of the market landscape. Probabilistic forecasts are particularly valuable because they account for market uncertainty, facilitating informed decision-making and risk management. Our model delivers state-of-the-art results, helping market participants to make informed decisions and operate their systems more efficiently.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)