Summary

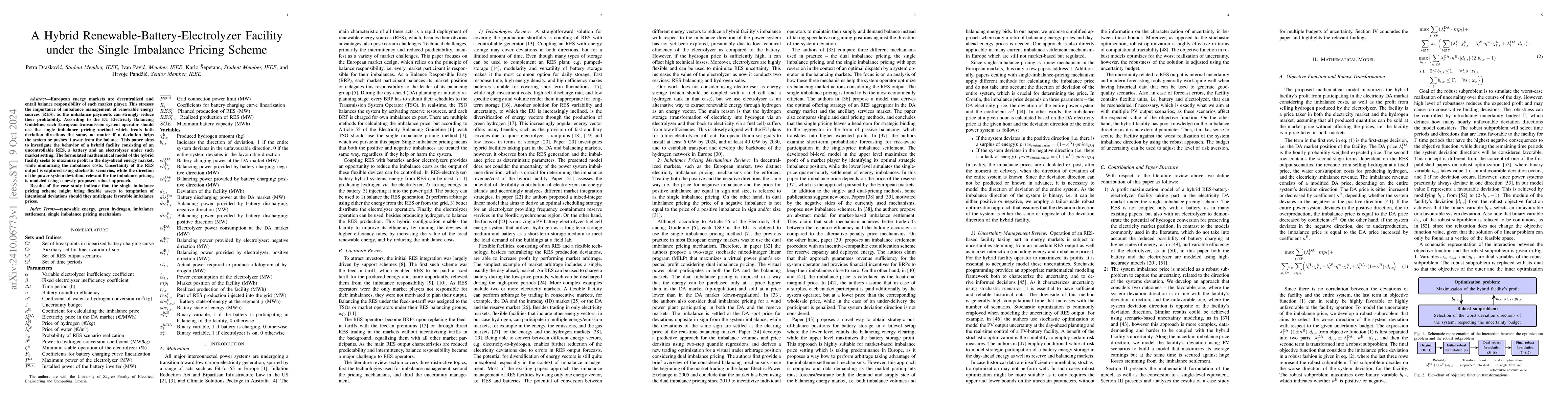

European energy markets are decentralized and entail balance responsibility of each market player. This stresses the importance of imbalance management of renewable energy sources (RES), as the imbalance payments can strongly reduce their profitability. According to the EU Electricity Balancing Guideline, each European transmission system operator should use the single imbalance pricing method which treats both deviation directions the same, no matter if a deviation helps the system or pushes it away from the balance. This paper aims to investigate the behavior of a hybrid facility consisting of an uncontrollable RES, a battery and an electrolyzer under such market setting. The formulated mathematical model of the hybrid facility seeks to maximize profit in the day-ahead energy market, while minimizing the imbalance costs. Uncertainty of the RES output is captured using stochastic scenarios, while the direction of the power system deviation, relevant for the imbalance pricing, is modeled using a newly proposed robust approach. Results of the case study indicate that the single imbalance pricing scheme might bring flexible assets to temptation of intentional deviations should they anticipate favorable imbalance prices.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersElectricity Market Bidding for Renewable Electrolyzer Plants: An Opportunity Cost Approach

Jalal Kazempour, Lesia Mitridati, Line Roald et al.

Weather-Driven Priority Charging for Battery Storage Systems in Hybrid Renewable Energy Grid

Dhrumil Bhatt, Siddharth Penumatsa, Nirbhay Singhal

No citations found for this paper.

Comments (0)