Authors

Summary

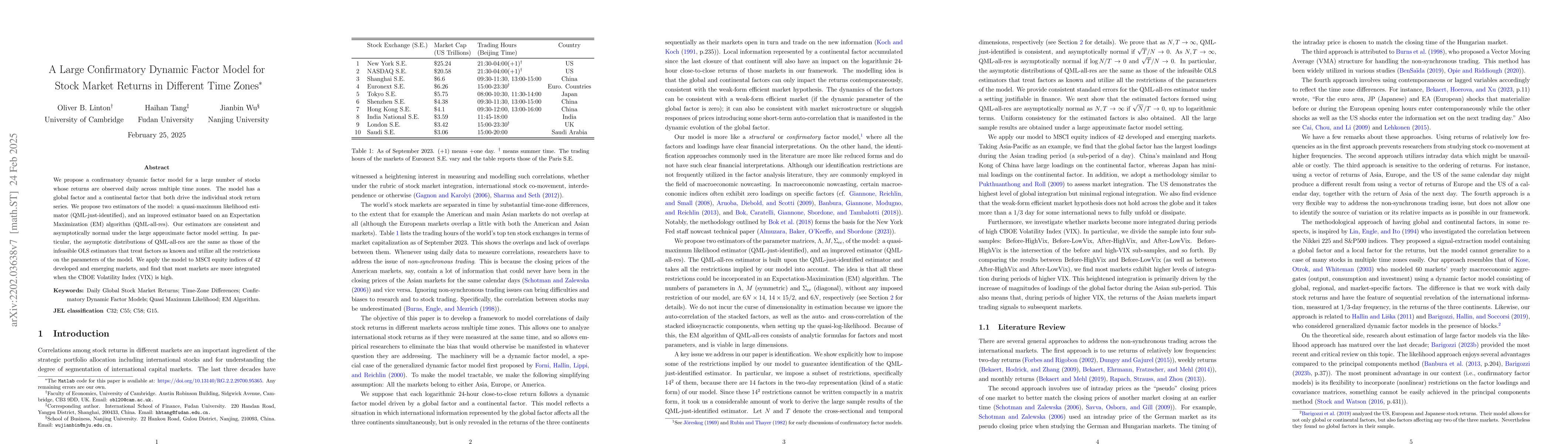

We propose a confirmatory dynamic factor model for a large number of daily returns across multiple time zones. The model has a global factor and three continental factors. We propose two estimators of the model: a quasi-maximum likelihood estimator (QML-just-identified), and an improved estimator (QML-all-res). Our estimators are consistent and asymptotically normal. In particular, the asymptotic distributions of QML-all-res are the same as those of the infeasible OLS estimators that treat factors as known and utilize all the restrictions of the parameters of the model. We apply the model to MSCI equity indices of 42 developed and emerging markets, and find that the market is more integrated when the US VIX is high.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)