Authors

Summary

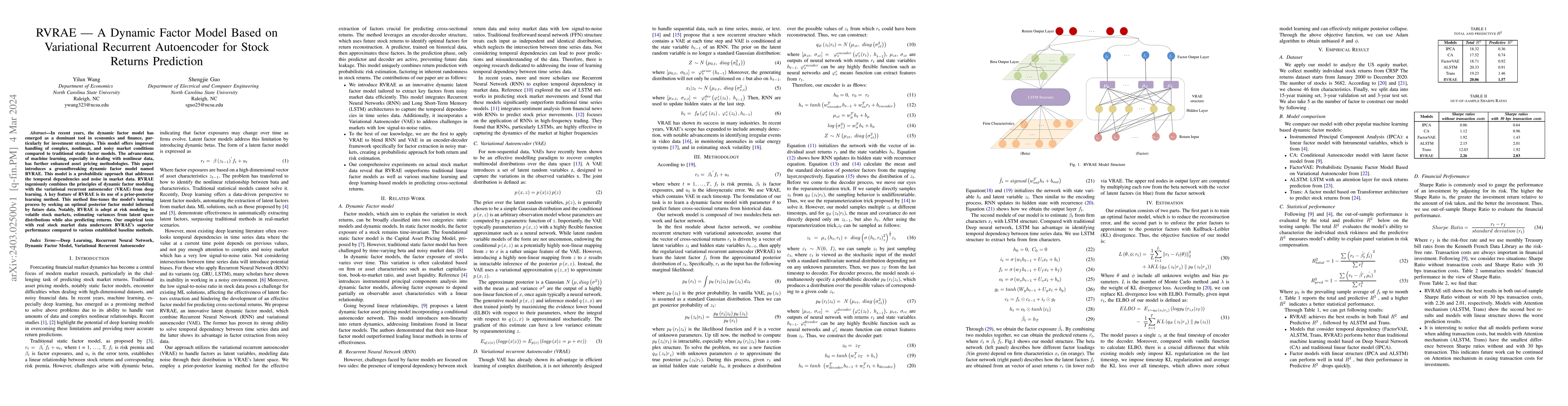

In recent years, the dynamic factor model has emerged as a dominant tool in economics and finance, particularly for investment strategies. This model offers improved handling of complex, nonlinear, and noisy market conditions compared to traditional static factor models. The advancement of machine learning, especially in dealing with nonlinear data, has further enhanced asset pricing methodologies. This paper introduces a groundbreaking dynamic factor model named RVRAE. This model is a probabilistic approach that addresses the temporal dependencies and noise in market data. RVRAE ingeniously combines the principles of dynamic factor modeling with the variational recurrent autoencoder (VRAE) from deep learning. A key feature of RVRAE is its use of a prior-posterior learning method. This method fine-tunes the model's learning process by seeking an optimal posterior factor model informed by future data. Notably, RVRAE is adept at risk modeling in volatile stock markets, estimating variances from latent space distributions while also predicting returns. Our empirical tests with real stock market data underscore RVRAE's superior performance compared to various established baseline methods.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersFactorGCL: A Hypergraph-Based Factor Model with Temporal Residual Contrastive Learning for Stock Returns Prediction

Jian Li, Weiran Wang, Yitong Duan

Diffusion Variational Autoencoder for Tackling Stochasticity in Multi-Step Regression Stock Price Prediction

Tat-Seng Chua, Yunshan Ma, Kelvin J. L. Koa et al.

A Large Confirmatory Dynamic Factor Model for Stock Market Returns in Different Time Zones

Oliver B. Linton, Haihan Tang, Jianbin Wu

| Title | Authors | Year | Actions |

|---|

Comments (0)