Summary

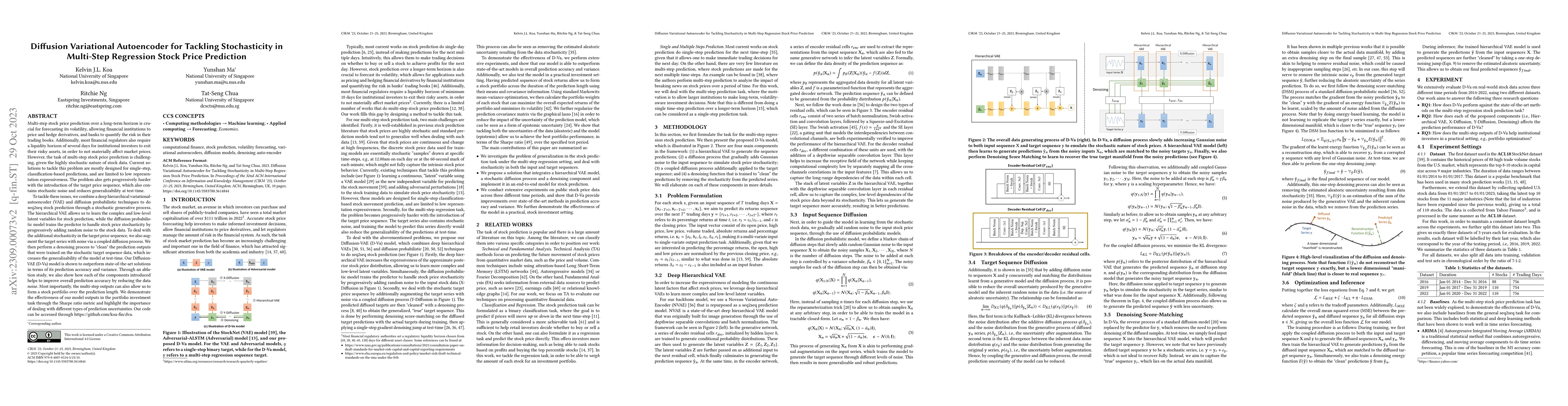

Multi-step stock price prediction over a long-term horizon is crucial for forecasting its volatility, allowing financial institutions to price and hedge derivatives, and banks to quantify the risk in their trading books. Additionally, most financial regulators also require a liquidity horizon of several days for institutional investors to exit their risky assets, in order to not materially affect market prices. However, the task of multi-step stock price prediction is challenging, given the highly stochastic nature of stock data. Current solutions to tackle this problem are mostly designed for single-step, classification-based predictions, and are limited to low representation expressiveness. The problem also gets progressively harder with the introduction of the target price sequence, which also contains stochastic noise and reduces generalizability at test-time. To tackle these issues, we combine a deep hierarchical variational-autoencoder (VAE) and diffusion probabilistic techniques to do seq2seq stock prediction through a stochastic generative process. The hierarchical VAE allows us to learn the complex and low-level latent variables for stock prediction, while the diffusion probabilistic model trains the predictor to handle stock price stochasticity by progressively adding random noise to the stock data. Our Diffusion-VAE (D-Va) model is shown to outperform state-of-the-art solutions in terms of its prediction accuracy and variance. More importantly, the multi-step outputs can also allow us to form a stock portfolio over the prediction length. We demonstrate the effectiveness of our model outputs in the portfolio investment task through the Sharpe ratio metric and highlight the importance of dealing with different types of prediction uncertainties.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-step-ahead Stock Price Prediction Using Recurrent Fuzzy Neural Network and Variational Mode Decomposition

Hamid Nasiri, Mohammad Mehdi Ebadzadeh

Tokenizing Stock Prices for Enhanced Multi-Step Forecast and Prediction

Haodong Chen, Xiaoming Chen, Qiang Qu et al.

Feature selection and regression methods for stock price prediction using technical indicators

Fatemeh Moodi, Amir Jahangard-Rafsanjani, Sajad Zarifzadeh

| Title | Authors | Year | Actions |

|---|

Comments (0)