Authors

Summary

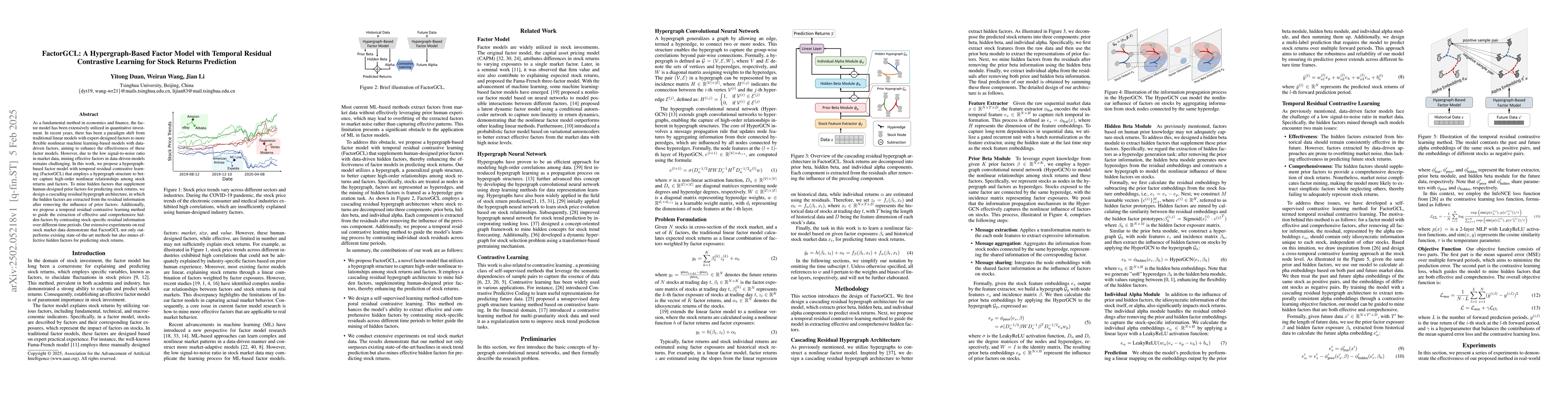

As a fundamental method in economics and finance, the factor model has been extensively utilized in quantitative investment. In recent years, there has been a paradigm shift from traditional linear models with expert-designed factors to more flexible nonlinear machine learning-based models with data-driven factors, aiming to enhance the effectiveness of these factor models. However, due to the low signal-to-noise ratio in market data, mining effective factors in data-driven models remains challenging. In this work, we propose a hypergraph-based factor model with temporal residual contrastive learning (FactorGCL) that employs a hypergraph structure to better capture high-order nonlinear relationships among stock returns and factors. To mine hidden factors that supplement human-designed prior factors for predicting stock returns, we design a cascading residual hypergraph architecture, in which the hidden factors are extracted from the residual information after removing the influence of prior factors. Additionally, we propose a temporal residual contrastive learning method to guide the extraction of effective and comprehensive hidden factors by contrasting stock-specific residual information over different time periods. Our extensive experiments on real stock market data demonstrate that FactorGCL not only outperforms existing state-of-the-art methods but also mines effective hidden factors for predicting stock returns.

AI Key Findings

Generated Jun 11, 2025

Methodology

The research proposes FactorGCL, a hypergraph-based factor model with temporal residual contrastive learning for stock returns prediction. It employs a cascading residual hypergraph architecture to extract prior, hidden, and individual alpha components from stock returns, capturing high-order nonlinear relationships among stock returns and factors.

Key Results

- FactorGCL outperforms existing state-of-the-art methods in predicting stock returns.

- The model effectively mines effective and comprehensive hidden factors supplementing human-designed prior factors.

- Extensive experiments on real stock market data demonstrate the superior performance of FactorGCL.

Significance

This research is significant as it addresses the challenge of low signal-to-noise ratio in market data by mining effective factors in data-driven models, enhancing the effectiveness of factor models in quantitative investment.

Technical Contribution

The main technical contribution is the design of FactorGCL, which utilizes a hypergraph structure to capture high-order nonlinear relationships and a temporal residual contrastive learning method to extract effective and comprehensive hidden factors.

Novelty

FactorGCL's novelty lies in its cascading residual hypergraph architecture and temporal residual contrastive learning method, which together enhance the extraction of effective and comprehensive hidden factors for stock returns prediction.

Limitations

- The paper does not discuss potential limitations or assumptions of the proposed model.

- No mention of computational complexity or scalability issues.

Future Work

- Explore applications of the hypergraph-based factor model in risk factor mining and portfolio optimization.

- Investigate the model's performance on different financial datasets and market conditions.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRVRAE: A Dynamic Factor Model Based on Variational Recurrent Autoencoder for Stock Returns Prediction

Yilun Wang, Shengjie Guo

Temporal-Relational Hypergraph Tri-Attention Networks for Stock Trend Prediction

Meng Wang, Xiaojie Li, Yilong Yin et al.

No citations found for this paper.

Comments (0)