Summary

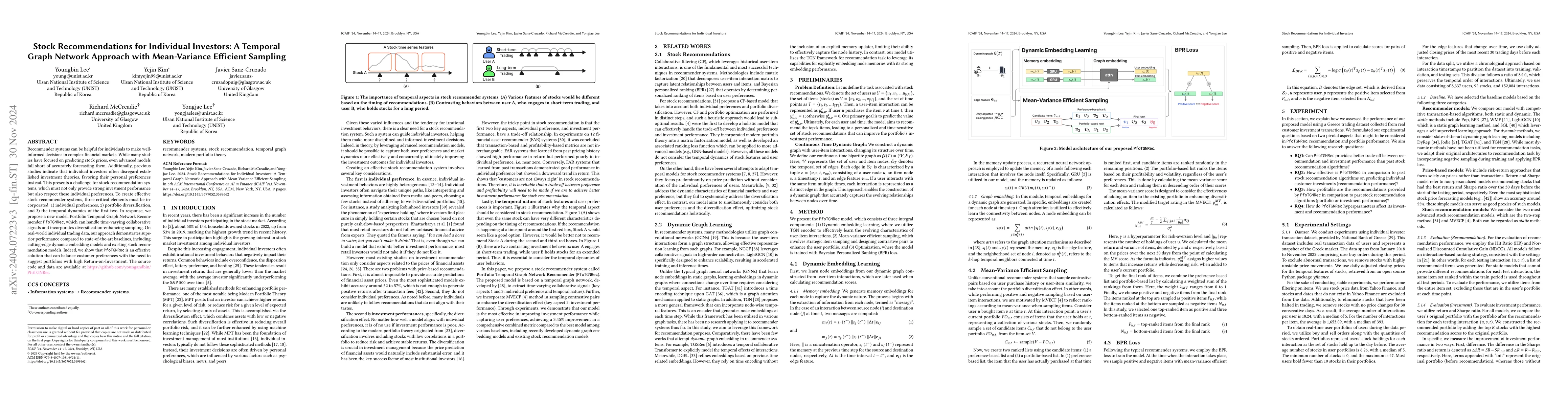

In complex financial markets, recommender systems can play a crucial role in empowering individuals to make informed decisions. Existing studies predominantly focus on price prediction, but even the most sophisticated models cannot accurately predict stock prices. Also, many studies show that most individual investors do not follow established investment theories because they have their own preferences. Hence, the tricky point in stock recommendation is that recommendations should give good investment performance but also should not ignore individual preferences. To develop effective stock recommender systems, it is essential to consider three key aspects: 1) individual preferences, 2) portfolio diversification, and 3) temporal aspect of both stock features and individual preferences. In response, we develop the portfolio temporal graph network recommender PfoTGNRec, which can handle time-varying collaborative signals and incorporates diversification-enhancing contrastive learning. As a result, our model demonstrated superior performance compared to various baselines, including cutting-edge dynamic embedding models and existing stock recommendation models, in a sense that our model exhibited good investment performance while maintaining competitive in capturing individual preferences. The source code and data are available at https://anonymous.4open.science/r/IJCAI2024-12F4.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersTemporal Graph Representation Learning with Adaptive Augmentation Contrastive

Huaming Wu, Pengfei Jiao, Hongjiang Chen et al.

Spatial-Temporal Graph Learning with Adversarial Contrastive Adaptation

Zheng Wang, Chao Huang, Ruihua Han et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)