Summary

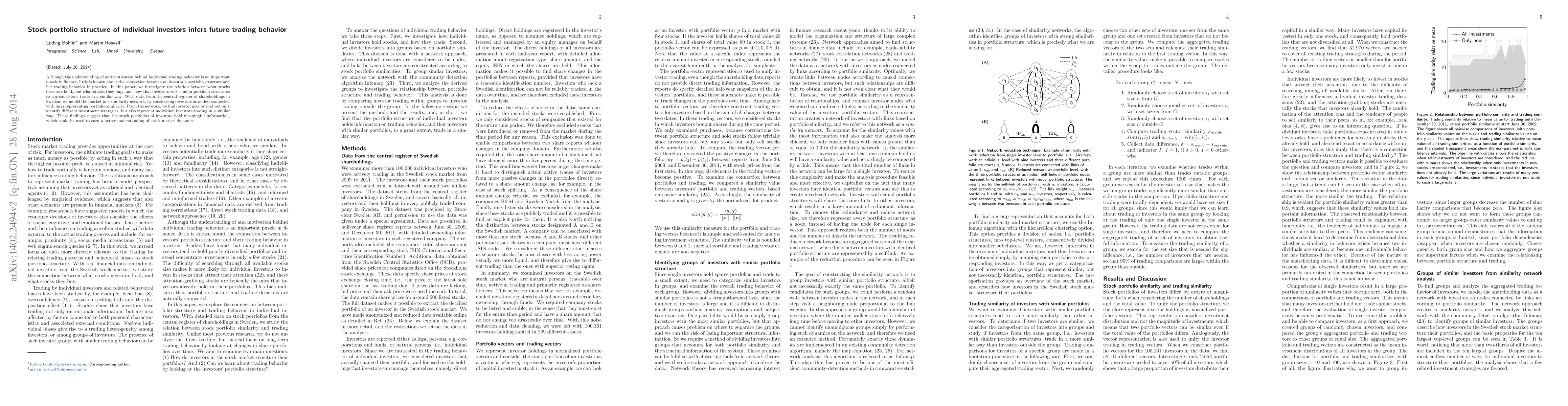

Although the understanding of and motivation behind individual trading behavior is an important puzzle in finance, little is known about the connection between an investor's portfolio structure and her trading behavior in practice. In this paper, we investigate the relation between what stocks investors hold, and what stocks they buy, and show that investors with similar portfolio structures to a great extent trade in a similar way. With data from the central register of shareholdings in Sweden, we model the market in a similarity network, by considering investors as nodes, connected with links representing portfolio similarity. From the network, we find groups of investors that not only identify different investment strategies, but also represent groups of individual investors trading in a similar way. These findings suggest that the stock portfolios of investors hold meaningful information, which could be used to earn a better understanding of stock market dynamics.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)