Summary

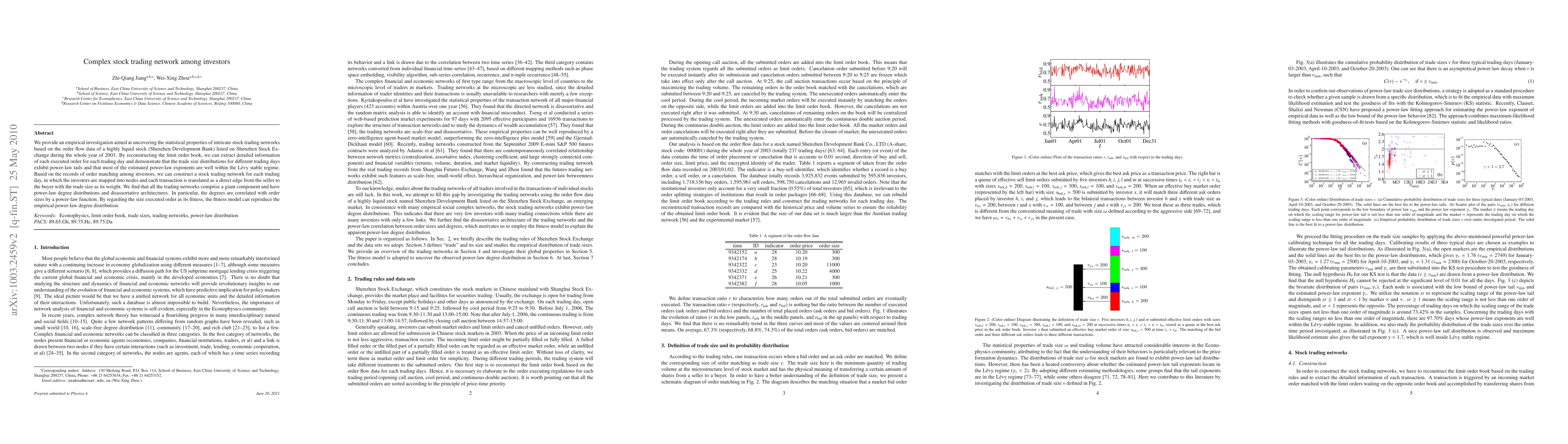

We provide an empirical investigation aimed at uncovering the statistical properties of intricate stock trading networks based on the order flow data of a highly liquid stock (Shenzhen Development Bank) listed on Shenzhen Stock Exchange during the whole year of 2003. By reconstructing the limit order book, we can extract detailed information of each executed order for each trading day and demonstrate that the trade size distributions for different trading days exhibit power-law tails and that most of the estimated power-law exponents are well within the L{\'e}vy stable regime. Based on the records of order matching among investors, we can construct a stock trading network for each trading day, in which the investors are mapped into nodes and each transaction is translated as a direct edge from the seller to the buyer with the trade size as its weight. We find that all the trading networks comprise a giant component and have power-law degree distributions and disassortative architectures. In particular, the degrees are correlated with order sizes by a power-law function. By regarding the size executed order as its fitness, the fitness model can reproduce the empirical power-law degree distribution.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersHow Covid mobility restrictions modified the population of investors in Italian stock markets

Fabrizio Lillo, Piero Mazzarisi, Adele Ravagnani et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)