Summary

This paper investigates how Covid mobility restrictions impacted the population of investors of the Italian stock market. The analysis tracks the trading activity of individual investors in Italian stocks in the period January 2019-September 2021, investigating how their composition and the trading activity changed around the Covid-19 lockdown period (March 9 - May 19, 2020) and more generally in the period of the pandemic. The results pinpoint that the lockdown restriction was accompanied by a surge in interest toward stock market, as testified by the trading volume by households. Given the generically falling prices during the lockdown, the households, which are typically contrarian, were net buyers, even if less than expected from their trading activity in 2019. This can be explained by the arrival, during the lockdown, of a group of about 185k new investors (i.e. which had never traded since January 2019) which were on average ten year younger and with a larger fraction of males than the pre-lockdown investors. By looking at the gross P&L, there is clear evidence that these new investors were more skilled in trading. There are thus indications that the lockdown, and more generally the Covid pandemic, created a sort of regime change in the population of financial investors.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

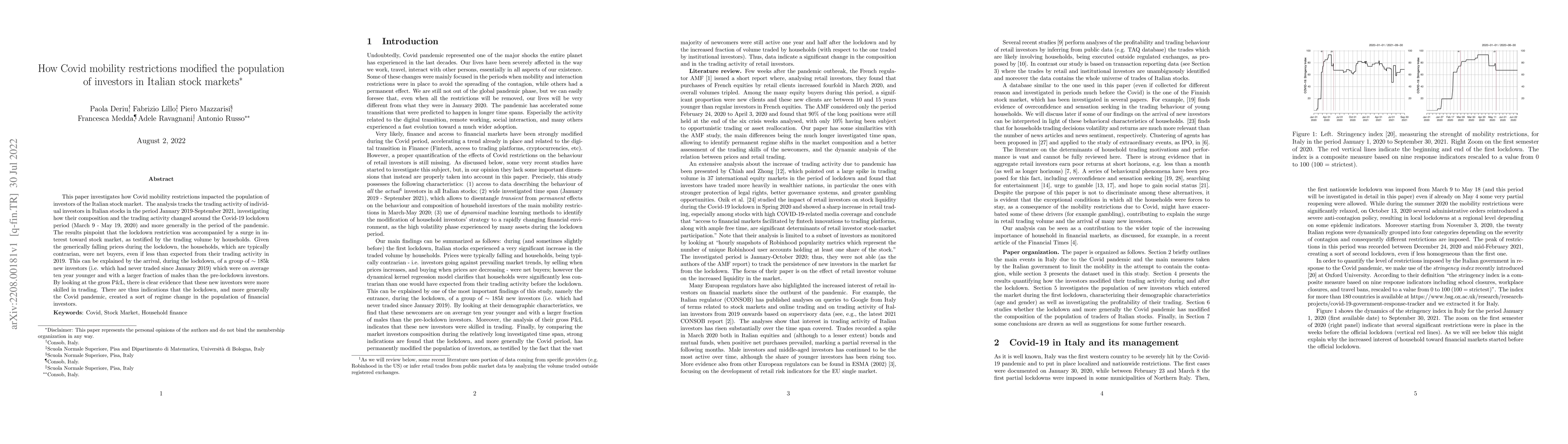

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersDisparities in greenspace access during COVID-19 mobility restrictions

David Lusseau, Rosie Baillie

| Title | Authors | Year | Actions |

|---|

Comments (0)