Fabrizio Lillo

25 papers on arXiv

Academic Profile

Statistics

Similar Authors

Papers on arXiv

Dimensionality reduction techniques to support insider trading detection

Identification of market abuse is an extremely complicated activity that requires the analysis of large and complex datasets. We propose an unsupervised machine learning method for contextual anomal...

Reinforcement Learning for Optimal Execution when Liquidity is Time-Varying

Optimal execution is an important problem faced by any trader. Most solutions are based on the assumption of constant market impact, while liquidity is known to be dynamic. Moreover, models with tim...

Online Learning of Order Flow and Market Impact with Bayesian Change-Point Detection Methods

Financial order flow exhibits a remarkable level of persistence, wherein buy (sell) trades are often followed by subsequent buy (sell) trades over extended periods. This persistence can be attribute...

A machine learning approach to support decision in insider trading detection

Identifying market abuse activity from data on investors' trading activity is very challenging both for the data volume and for the low signal to noise ratio. Here we propose two complementary unsup...

Network-wide assessment of ATM mechanisms using an agent-based model

This paper presents results from the SESAR ER3 Domino project. Three mechanisms are assessed at the ECAC-wide level: 4D trajectory adjustments (a combination of actively waiting for connecting passe...

How Covid mobility restrictions modified the population of investors in Italian stock markets

This paper investigates how Covid mobility restrictions impacted the population of investors of the Italian stock market. The analysis tracks the trading activity of individual investors in Italian ...

Transient impact from the Nash equilibrium of a permanent market impact game

A large body of empirical literature has shown that market impact of financial prices is transient. However, from a theoretical standpoint, the origin of this temporary nature is still unclear. We s...

From Zero-Intelligence to Queue-Reactive: Limit Order Book modeling for high-frequency volatility estimation and optimal execution

The estimation of the volatility with high-frequency data is plagued by the presence of microstructure noise, which leads to biased measures. Alternative estimators have been developed and tested ei...

Score Driven Generalized Fitness Model for Sparse and Weighted Temporal Networks

While the vast majority of the literature on models for temporal networks focuses on binary graphs, often one can associate a weight to each link. In such cases the data are better described by a we...

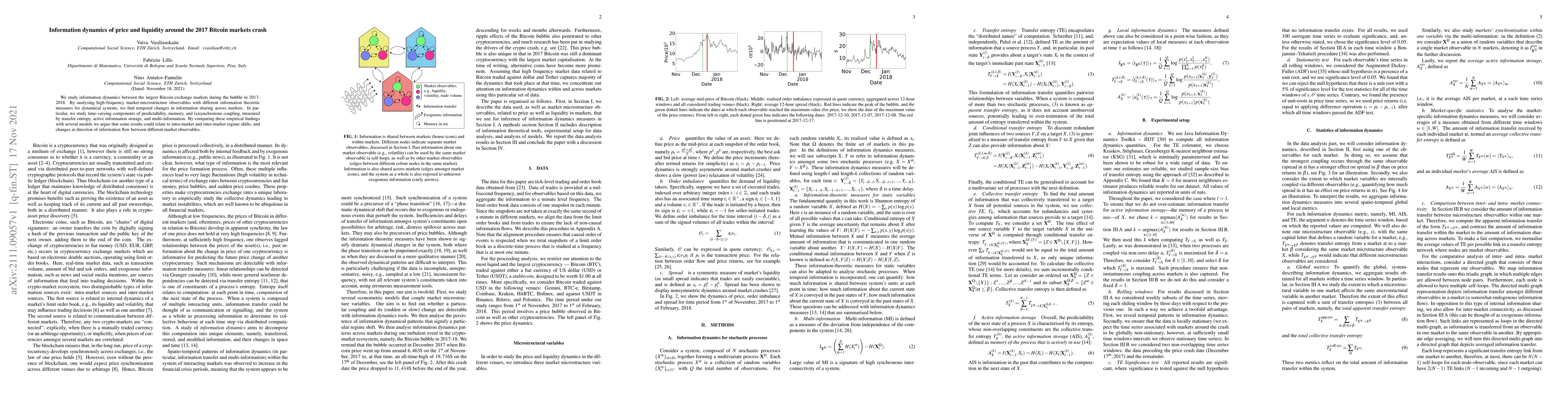

Information dynamics of price and liquidity around the 2017 Bitcoin markets crash

We study the information dynamics between the largest Bitcoin exchange markets during the bubble in 2017-2018. By analysing high-frequency market-microstructure observables with different informatio...

Instabilities in Multi-Asset and Multi-Agent Market Impact Games

We consider the general problem of a set of agents trading a portfolio of assets in the presence of transient price impact and additional quadratic transaction costs and we study, with analytical an...

Unveiling the relation between herding and liquidity with trader lead-lag networks

We propose a method to infer lead-lag networks of traders from the observation of their trade record as well as to reconstruct their state of supply and demand when they do not trade. The method rel...

Robust Recursive Filtering and Smoothing

Using a perturbation technique, we derive a new approximate filtering and smoothing methodology generalizing along different directions several existing approaches to robust filtering based on the s...

Bayesian Autoregressive Online Change-Point Detection with Time-Varying Parameters

Change points in real-world systems mark significant regime shifts in system dynamics, possibly triggered by exogenous or endogenous factors. These points define regimes for the time evolution of the ...

Deviations from the Nash equilibrium and emergence of tacit collusion in a two-player optimal execution game with reinforcement learning

The use of reinforcement learning algorithms in financial trading is becoming increasingly prevalent. However, the autonomous nature of these algorithms can lead to unexpected outcomes that deviate fr...

Filtering and Statistical Properties of Unimodal Maps Perturbed by Heteroscedastic Noises

We propose a theory of unimodal maps perturbed by an heteroscedastic Markov chain noise and experiencing another heteroscedastic noise due to uncertain observation. We address and treat the filtering ...

CAESar: Conditional Autoregressive Expected Shortfall

In financial risk management, Value at Risk (VaR) is widely used to estimate potential portfolio losses. VaR's limitation is its inability to account for the magnitude of losses beyond a certain thres...

Optimal execution with deterministically time varying liquidity: well posedness and price manipulation

We investigate the well-posedness in the Hadamard sense and the absence of price manipulation in the optimal execution problem within the Almgren-Chriss framework, where the temporary and permanent im...

Modelling shock propagation and resilience in financial temporal networks

Modelling how a shock propagates in a temporal network and how the system relaxes back to equilibrium is challenging but important in many applications, such as financial systemic risk. Most studies s...

Why is the estimation of metaorder impact with public market data so challenging?

Estimating market impact and transaction costs of large trades (metaorders) is a very important topic in finance. However, using models of price and trade based on public market data provide average p...

A Sea of Coins: The Proliferation of Cryptocurrencies in UniswapV2

Blockchain technology has revolutionized financial markets by enabling decentralized exchanges (DEXs) that operate without intermediaries. Uniswap V2, a leading DEX, facilitates the rapid creation and...

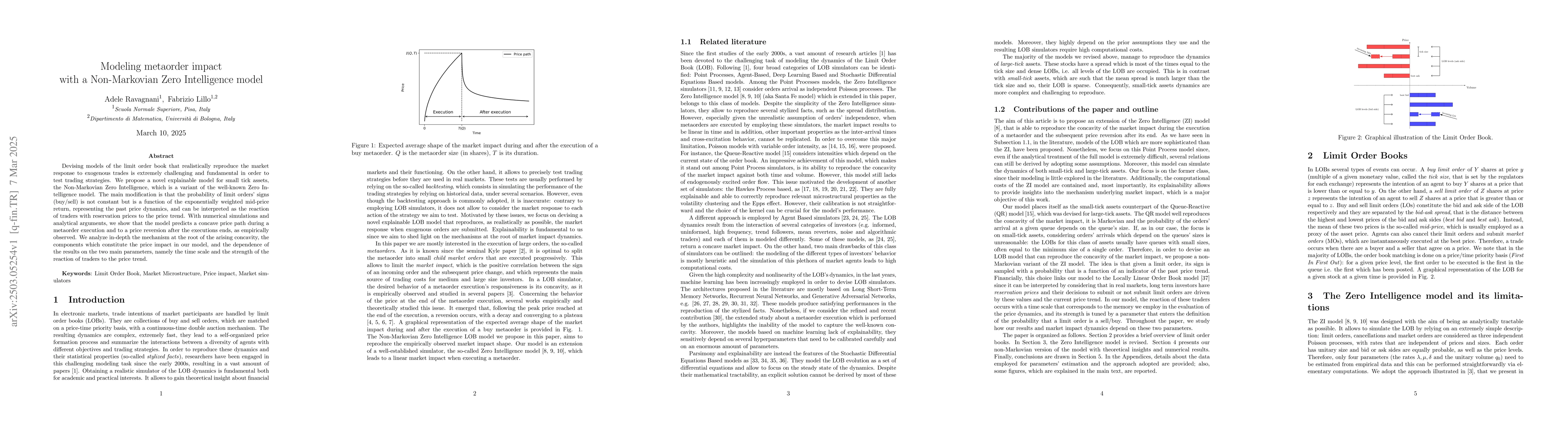

Modeling metaorder impact with a Non-Markovian Zero Intelligence model

Devising models of the limit order book that realistically reproduce the market response to exogenous trades is extremely challenging and fundamental in order to test trading strategies. We propose a ...

Tackling estimation risk in Kelly investing using options

The Kelly criterion provides a general framework for optimizing the growth rate of an investment portfolio over time by maximizing the expected logarithmic utility of wealth. However, the optimality c...

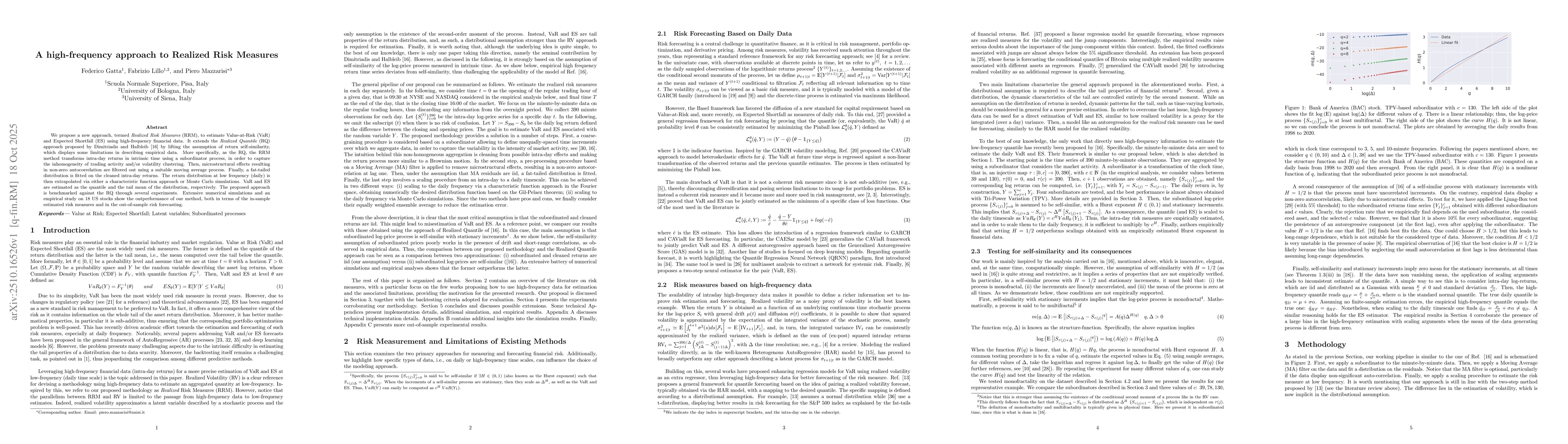

A high-frequency approach to Realized Risk Measures

We propose a new approach, termed Realized Risk Measures (RRM), to estimate Value-at-Risk (VaR) and Expected Shortfall (ES) using high-frequency financial data. It extends the Realized Quantile (RQ) a...

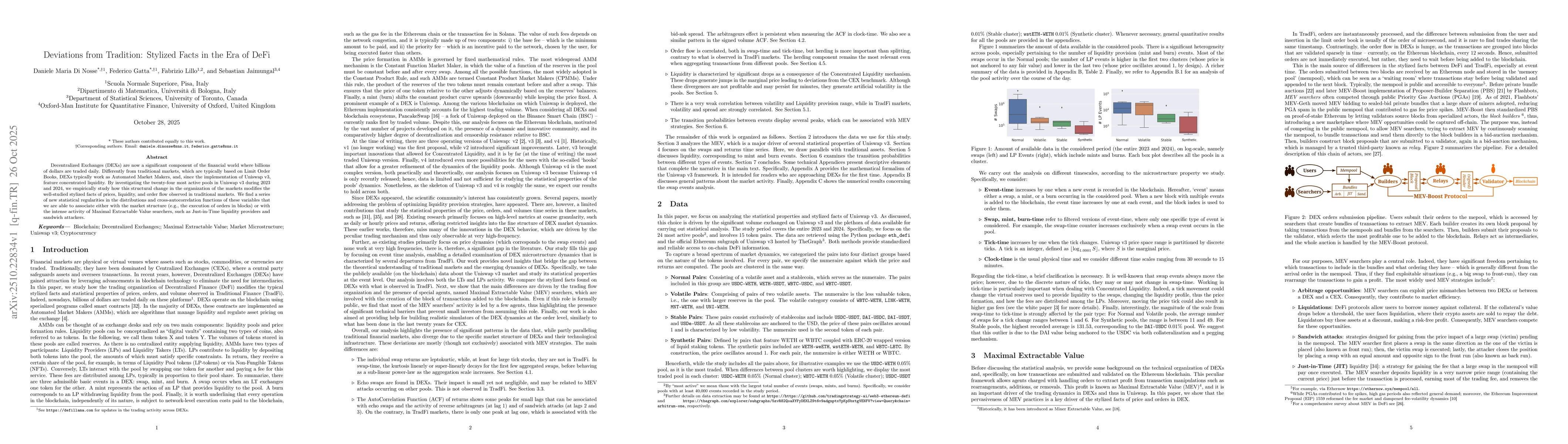

Deviations from Tradition: Stylized Facts in the Era of DeFi

Decentralized Exchanges (DEXs) are now a significant component of the financial world where billions of dollars are traded daily. Differently from traditional markets, which are typically based on Lim...