Summary

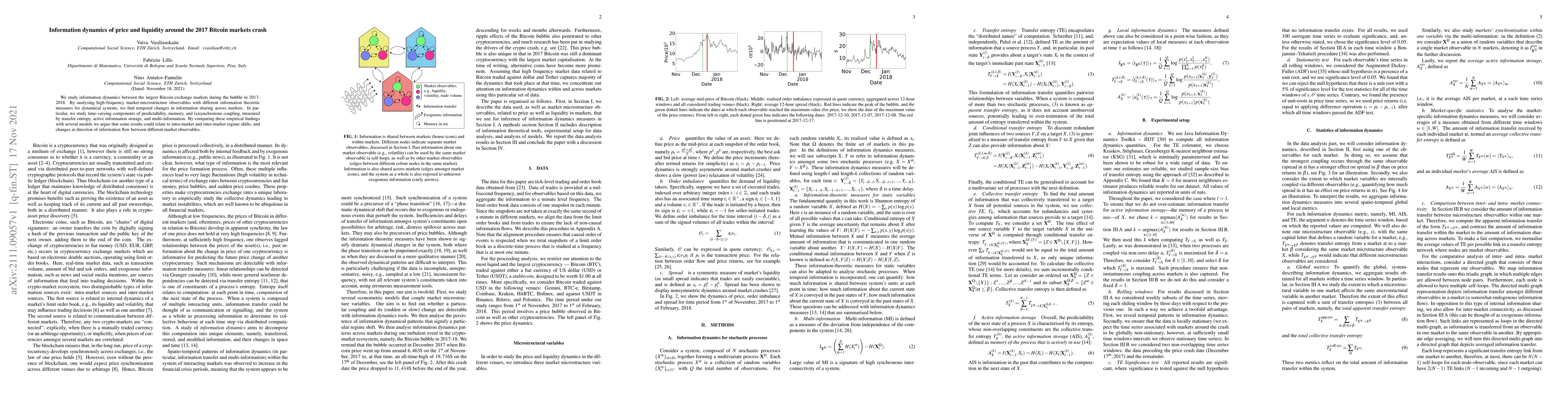

We study the information dynamics between the largest Bitcoin exchange markets during the bubble in 2017-2018. By analysing high-frequency market-microstructure observables with different information theoretic measures for dynamical systems, we find temporal changes in information sharing across markets. In particular, we study the time-varying components of predictability, memory, and synchronous coupling, measured by transfer entropy, active information storage, and multi-information. By comparing these empirical findings with several models we argue that some results could relate to intra-market and inter-market regime shifts, and changes in direction of information flow between different market observables.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersPrice Discovery in Cryptocurrency Markets

Juan Plazuelo Pascual, Carlos Tardon Rubio, Juan Toro Cebada et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)