Summary

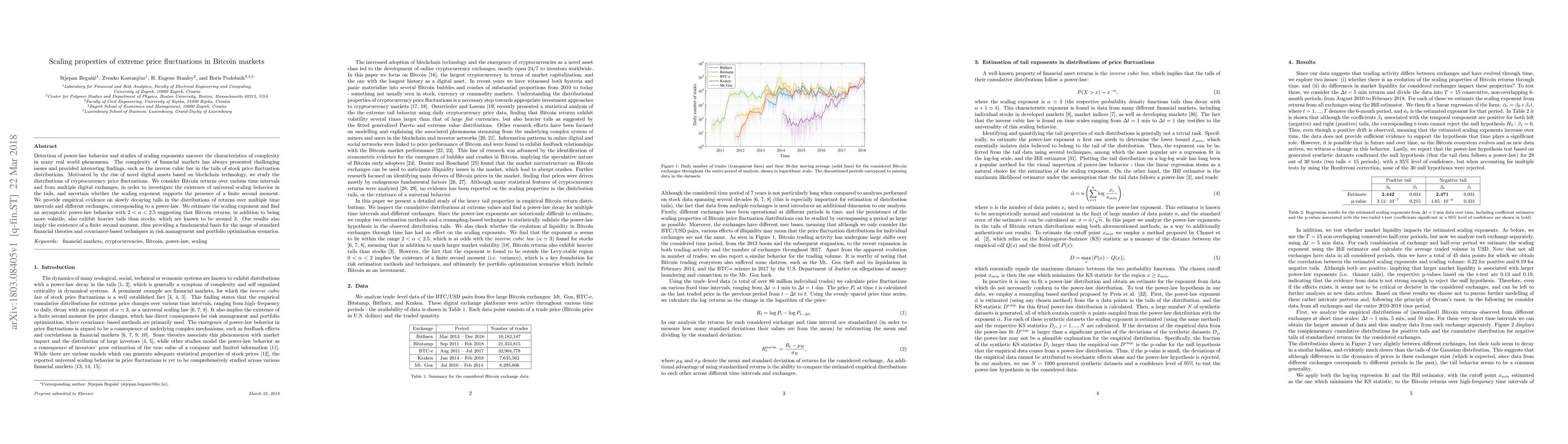

Detection of power-law behavior and studies of scaling exponents uncover the characteristics of complexity in many real world phenomena. The complexity of financial markets has always presented challenging issues and provided interesting findings, such as the inverse cubic law in the tails of stock price fluctuation distributions. Motivated by the rise of novel digital assets based on blockchain technology, we study the distributions of cryptocurrency price fluctuations. We consider Bitcoin returns over various time intervals and from multiple digital exchanges, in order to investigate the existence of universal scaling behavior in the tails, and ascertain whether the scaling exponent supports the presence of a finite second moment. We provide empirical evidence on slowly decaying tails in the distributions of returns over multiple time intervals and different exchanges, corresponding to a power-law. We estimate the scaling exponent and find an asymptotic power-law behavior with 2 < {\alpha} < 2.5 suggesting that Bitcoin returns, in addition to being more volatile, also exhibit heavier tails than stocks, which are known to be around 3. Our results also imply the existence of a finite second moment, thus providing a fundamental basis for the usage of standard financial theories and covariance-based techniques in risk management and portfolio optimization scenarios.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)