Summary

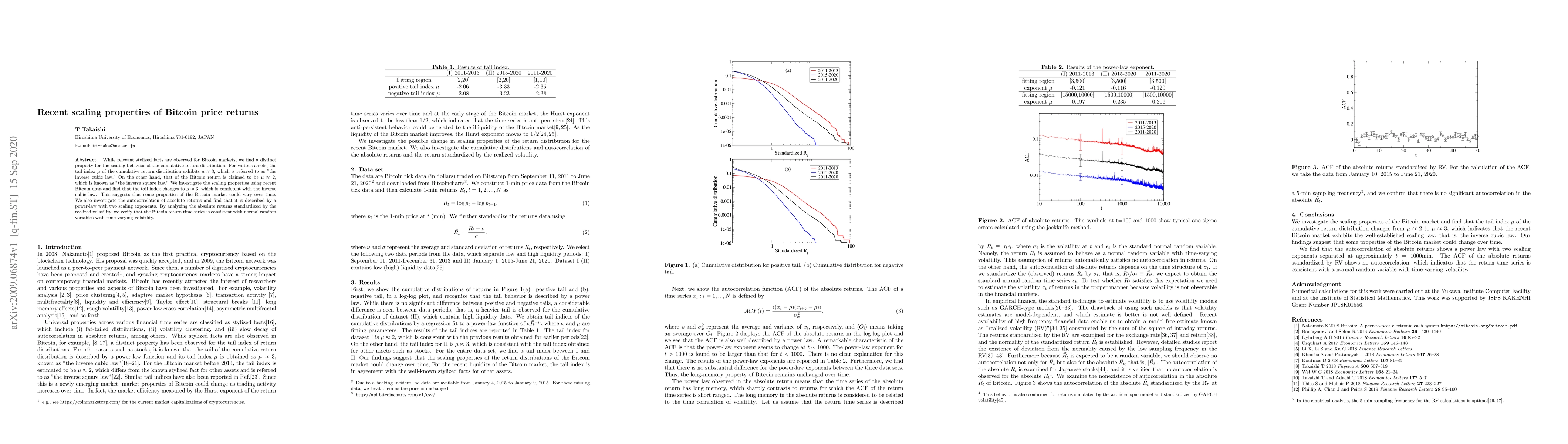

While relevant stylized facts are observed for Bitcoin markets, we find a distinct property for the scaling behavior of the cumulative return distribution. For various assets, the tail index $\mu$ of the cumulative return distribution exhibits $\mu \approx 3$, which is referred to as "the inverse cubic law." On the other hand, that of the Bitcoin return is claimed to be $\mu \approx 2$, which is known as "the inverse square law." We investigate the scaling properties using recent Bitcoin data and find that the tail index changes to $\mu \approx 3$, which is consistent with the inverse cubic law. This suggests that some properties of the Bitcoin market could vary over time. We also investigate the autocorrelation of absolute returns and find that it is described by a power-law with two scaling exponents. By analyzing the absolute returns standardized by the realized volatility, we verify that the Bitcoin return time series is consistent with normal random variables with time-varying volatility.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)