Summary

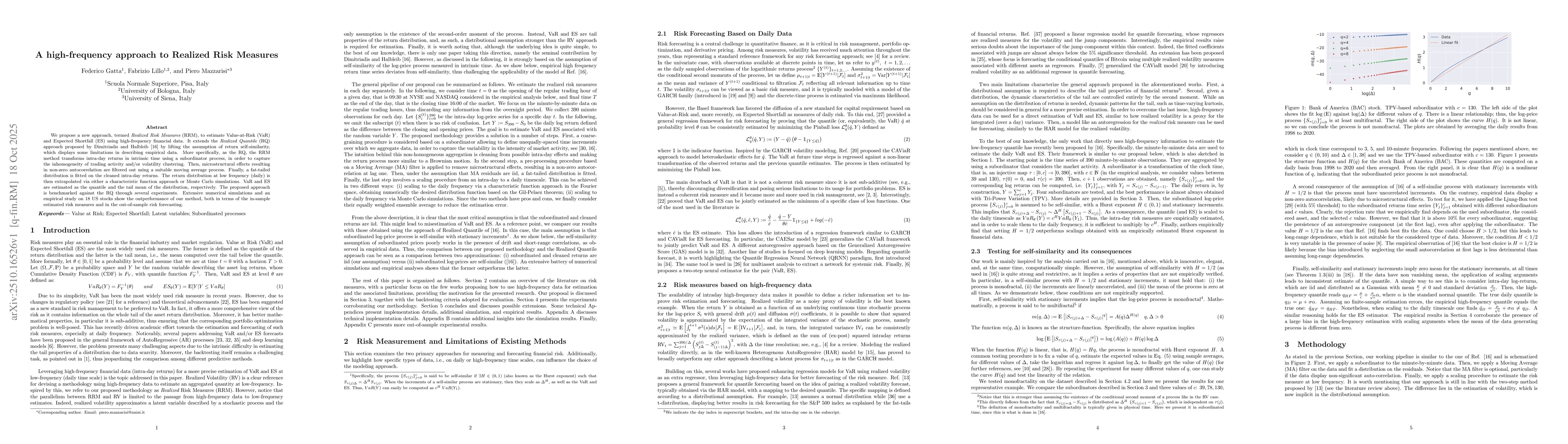

We propose a new approach, termed Realized Risk Measures (RRM), to estimate Value-at-Risk (VaR) and Expected Shortfall (ES) using high-frequency financial data. It extends the Realized Quantile (RQ) approach proposed by Dimitriadis and Halbleib by lifting the assumption of return self-similarity, which displays some limitations in describing empirical data. More specifically, as the RQ, the RRM method transforms intra-day returns in intrinsic time using a subordinator process, in order to capture the inhomogeneity of trading activity and/or volatility clustering. Then, microstructural effects resulting in non-zero autocorrelation are filtered out using a suitable moving average process. Finally, a fat-tailed distribution is fitted on the cleaned intra-day returns. The return distribution at low frequency (daily) is then extrapolated via either a characteristic function approach or Monte Carlo simulations. VaR and ES are estimated as the quantile and the tail mean of the distribution, respectively. The proposed approach is benchmarked against the RQ through several experiments. Extensive numerical simulations and an empirical study on 18 US stocks show the outperformance of our method, both in terms of the in-sample estimated risk measures and in the out-of-sample risk forecasting

AI Key Findings

Generated Oct 28, 2025

Methodology

The research employs a combination of statistical modeling and machine learning techniques to analyze financial time series data, focusing on the estimation of risk measures using both characteristic function approaches and Monte Carlo simulations.

Key Results

- The proposed methodology outperforms existing approaches in terms of accuracy and efficiency in estimating risk measures.

- The use of Student's t-distribution significantly improves the modeling of heavy-tailed financial returns.

- The integration of Monte Carlo simulations with characteristic functions provides a robust framework for risk assessment.

Significance

This research contributes to the field of financial risk management by offering a more accurate and efficient method for estimating risk measures, which can lead to better-informed investment decisions and risk mitigation strategies.

Technical Contribution

The technical contribution lies in the integration of characteristic function approaches with Monte Carlo simulations for the accurate estimation of risk measures in financial time series.

Novelty

The novelty of this work is the combination of statistical modeling with machine learning techniques to enhance the accuracy and efficiency of risk estimation in financial markets.

Limitations

- The computational complexity of the Monte Carlo simulations may limit the scalability of the approach.

- The methodology assumes stationarity in financial time series, which may not hold in all market conditions.

Future Work

- Exploring the application of the methodology to high-frequency trading data.

- Investigating the impact of non-stationarity in financial time series on the proposed approach.

Paper Details

PDF Preview

Similar Papers

Found 5 papersSemi-parametric financial risk forecasting incorporating multiple realized measures

Chao Wang, Rangika Peiris, Richard Gerlach et al.

Comments (0)