Authors

Summary

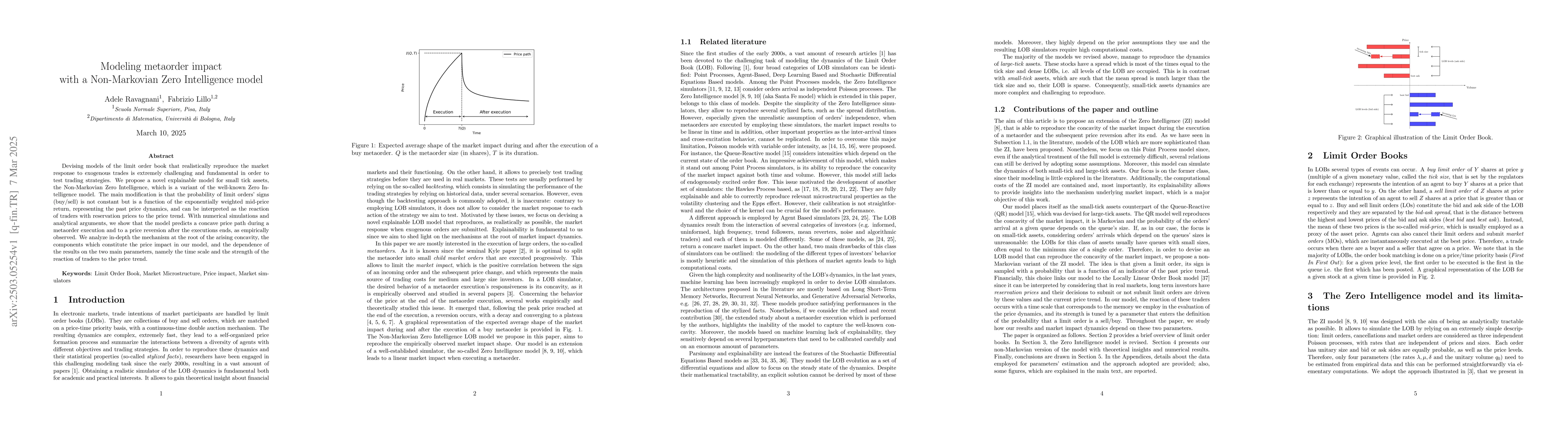

Devising models of the limit order book that realistically reproduce the market response to exogenous trades is extremely challenging and fundamental in order to test trading strategies. We propose a novel explainable model for small tick assets, the Non-Markovian Zero Intelligence, which is a variant of the well-known Zero Intelligence model. The main modification is that the probability of limit orders' signs (buy/sell) is not constant but is a function of the exponentially weighted mid-price return, representing the past price dynamics, and can be interpreted as the reaction of traders with reservation prices to the price trend. With numerical simulations and analytical arguments, we show that the model predicts a concave price path during a metaorder execution and to a price reversion after the executions ends, as empirically observed. We analyze in-depth the mechanism at the root of the arising concavity, the components which constitute the price impact in our model, and the dependence of the results on the two main parameters, namely the time scale and the strength of the reaction of traders to the price trend.

AI Key Findings

Generated Jun 10, 2025

Methodology

The research introduces a Non-Markovian Zero Intelligence (NMZI) model, a variant of the Zero Intelligence model, to simulate the limit order book dynamics and model metaorder impact. This model considers price-dependent probabilities for limit orders, capturing traders with reservation prices responding to price trends.

Key Results

- The NMZI model successfully reproduces the concave price path during metaorder execution and subsequent price reversion after execution, observed empirically.

- Two regimes are identified: an initial concave regime followed by a stationary linear impact regime as the number of child market orders increases.

- The model's impact components are analyzed, showing that the reversion mechanism is the major contributor to the decrease in overall impact, causing the concavity in the mid-price trajectory.

- The price decay after metaorder execution is modeled to exponentially decrease, mirroring the reversion observed between child market orders.

- The role of parameters β2 and α is investigated, with longer memory (smaller β2) leading to a more pronounced reversion and slower convergence to the stationary regime.

Significance

This research provides a novel, explainable model for small-tick assets that captures the market impact's concavity and post-execution price reversion, which is crucial for testing trading strategies in a realistic framework.

Technical Contribution

The NMZI model extends the Zero Intelligence model by introducing price-dependent probabilities for limit orders, providing a more realistic representation of trader behavior and market dynamics.

Novelty

The model's novelty lies in its ability to capture the concavity of market impact during metaorder execution and the subsequent price reversion after execution, which previous models like the standard Zero Intelligence model fail to do.

Limitations

- The model focuses on metaorders with constant speed and does not explore more complex trading strategies.

- The choice of the exponentially weighted mid-price return as the past price dynamics indicator may not be the only suitable kernel.

- The time-varying probability for limit order signs is defined as a sigmoid function; other functional forms could be considered.

Future Work

- Investigate more complex trading strategies beyond constant-speed metaorders.

- Explore alternative kernels for modeling past price trends, such as power-law functions.

- Consider time-varying probabilities for cancellation signs based on past price trends.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhy is the estimation of metaorder impact with public market data so challenging?

Fabrizio Lillo, Manuel Naviglio, Giacomo Bormetti et al.

No citations found for this paper.

Comments (0)