Summary

We present a thorough empirical analysis of market impact on the Bitcoin/USD exchange market using a complete dataset that allows us to reconstruct more than one million metaorders. We empirically confirm the "square-root law'' for market impact, which holds on four decades in spite of the quasi-absence of statistical arbitrage and market marking strategies. We show that the square-root impact holds during the whole trajectory of a metaorder and not only for the final execution price. We also attempt to decompose the order flow into an "informed'' and "uninformed'' component, the latter leading to an almost complete long-term decay of impact. This study sheds light on the hypotheses and predictions of several market impact models recently proposed in the literature and promotes heterogeneous agent models as promising candidates to explain price impact on the Bitcoin market -- and, we believe, on other markets as well.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

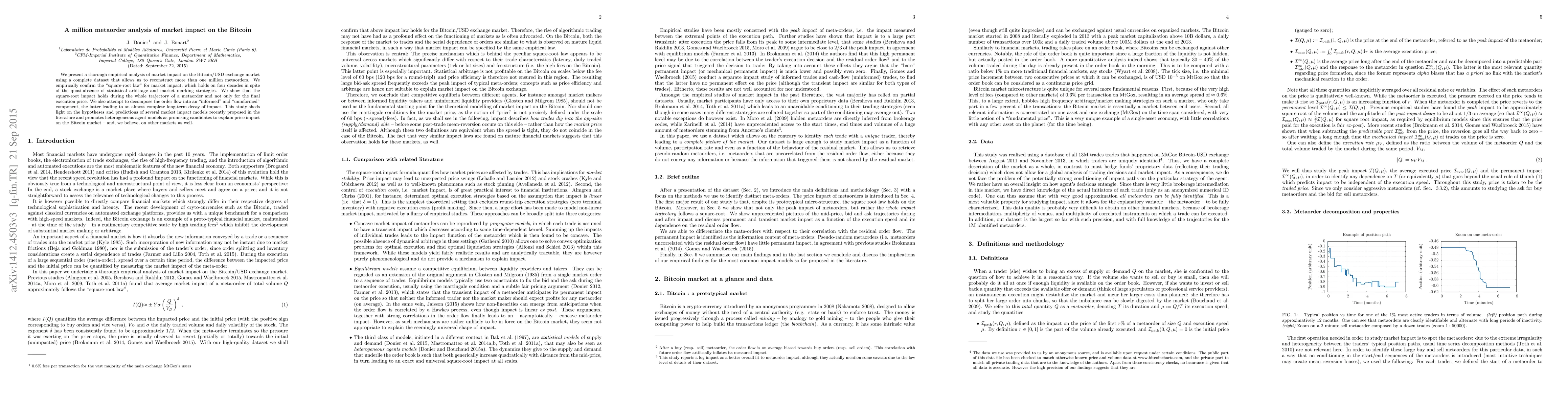

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersWhy is the estimation of metaorder impact with public market data so challenging?

Fabrizio Lillo, Manuel Naviglio, Giacomo Bormetti et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)