Summary

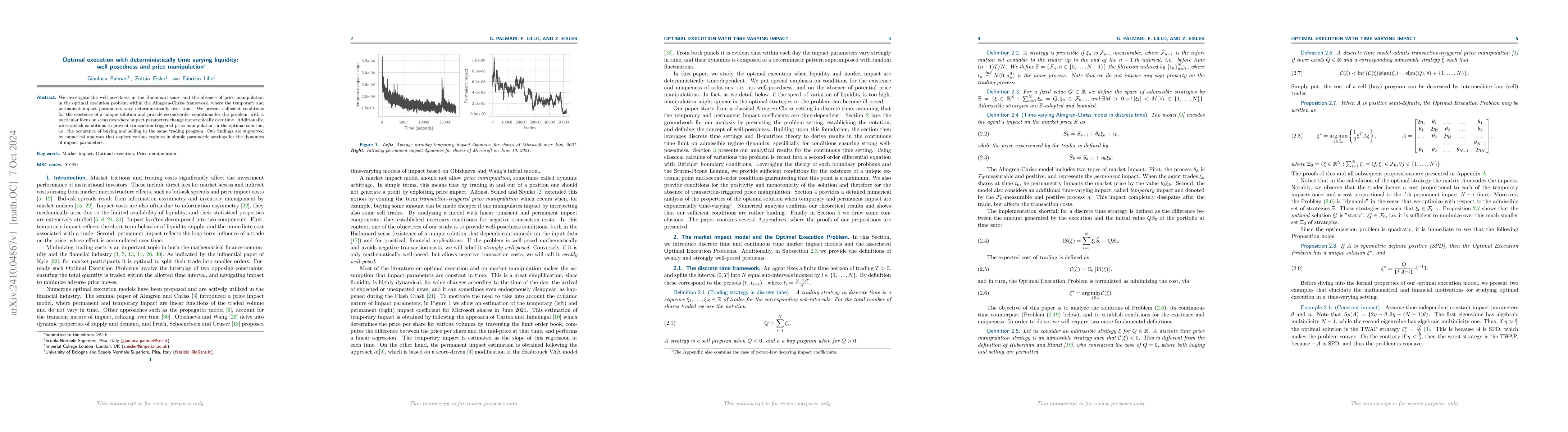

We investigate the well-posedness in the Hadamard sense and the absence of price manipulation in the optimal execution problem within the Almgren-Chriss framework, where the temporary and permanent impact parameters vary deterministically over time. We present sufficient conditions for the existence of a unique solution and provide second-order conditions for the problem, with a particular focus on scenarios where impact parameters change monotonically over time. Additionally, we establish conditions to prevent transaction-triggered price manipulation in the optimal solution, i.e. the occurence of buying and selling in the same trading program. Our findings are supported by numerical analyses that explore various regimes in simple parametric settings for the dynamics of impact parameters.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersReinforcement Learning for Optimal Execution when Liquidity is Time-Varying

Fabrizio Lillo, Andrea Macrì

Optimal Execution under Liquidity Uncertainty

Sergio Pulido, Etienne Chevalier, Yadh Hafsi et al.

No citations found for this paper.

Comments (0)