Summary

In financial markets, liquidity is not constant over time but exhibits strong seasonal patterns. In this article we consider a limit order book model that allows for time-dependent, deterministic depth and resilience of the book and determine optimal portfolio liquidation strategies. In a first model variant, we propose a trading dependent spread that increases when market orders are matched against the order book. In this model no price manipulation occurs and the optimal strategy is of the wait region - buy region type often encountered in singular control problems. In a second model, we assume that there is no spread in the order book. Under this assumption we find that price manipulation can occur, depending on the model parameters. Even in the absence of classical price manipulation there may be transaction triggered price manipulation. In specific cases, we can state the optimal strategy in closed form.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

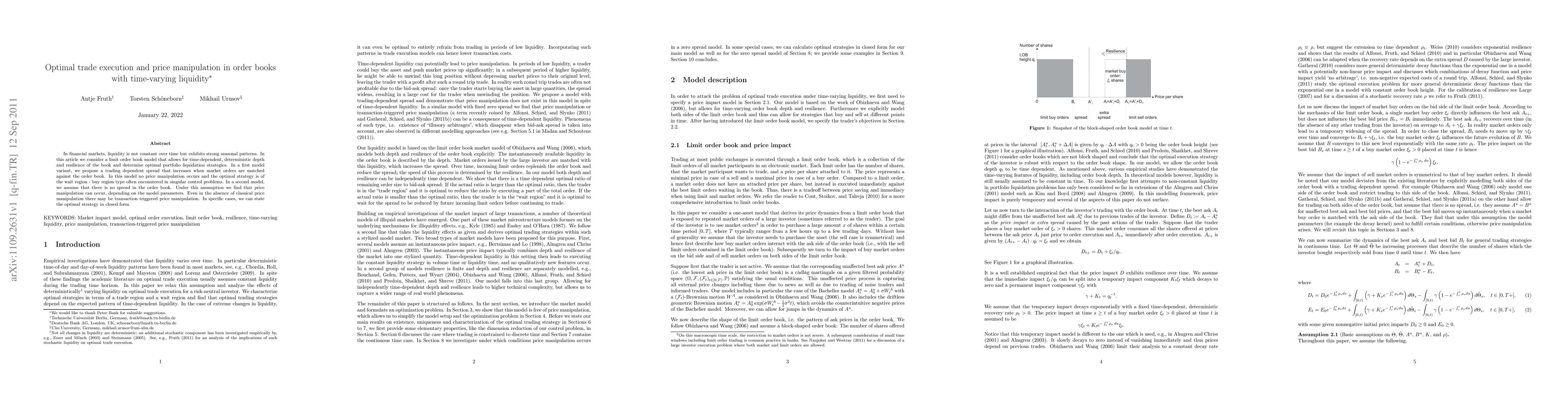

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersOptimal execution with deterministically time varying liquidity: well posedness and price manipulation

Fabrizio Lillo, Zoltan Eisler, Gianluca Palmari

Reinforcement Learning for Optimal Execution when Liquidity is Time-Varying

Fabrizio Lillo, Andrea Macrì

| Title | Authors | Year | Actions |

|---|

Comments (0)