Summary

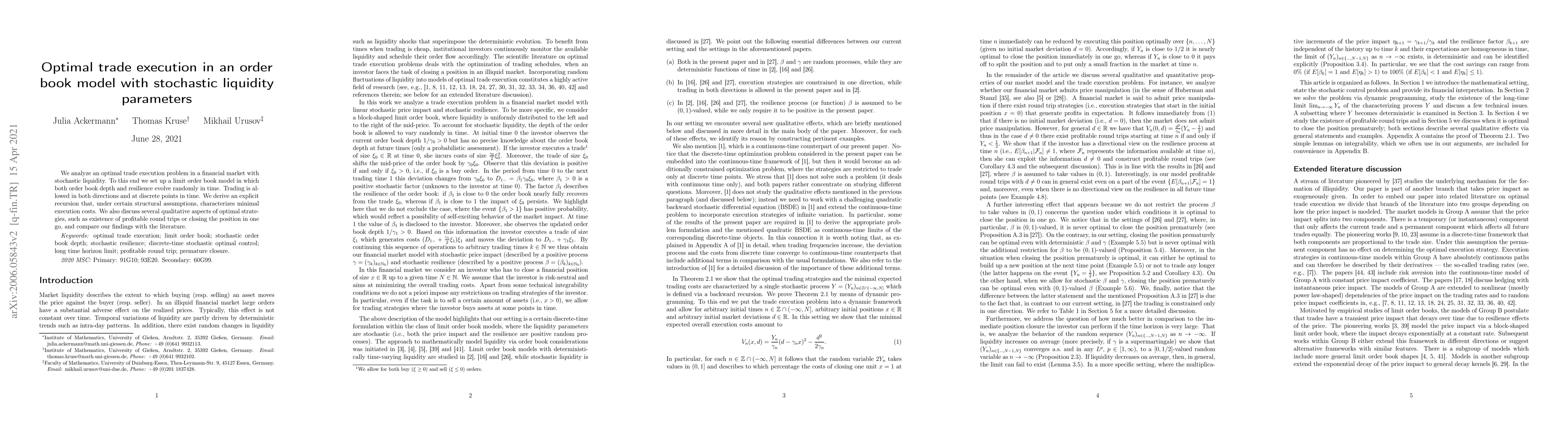

We analyze an optimal trade execution problem in a financial market with stochastic liquidity. To this end we set up a limit order book model in which both order book depth and resilience evolve randomly in time. Trading is allowed in both directions and at discrete points in time. We derive an explicit recursion that, under certain structural assumptions, characterizes minimal execution costs. We also discuss several qualitative aspects of optimal strategies, such as existence of profitable round trips or closing the position in one go, and compare our findings with the literature.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)