Summary

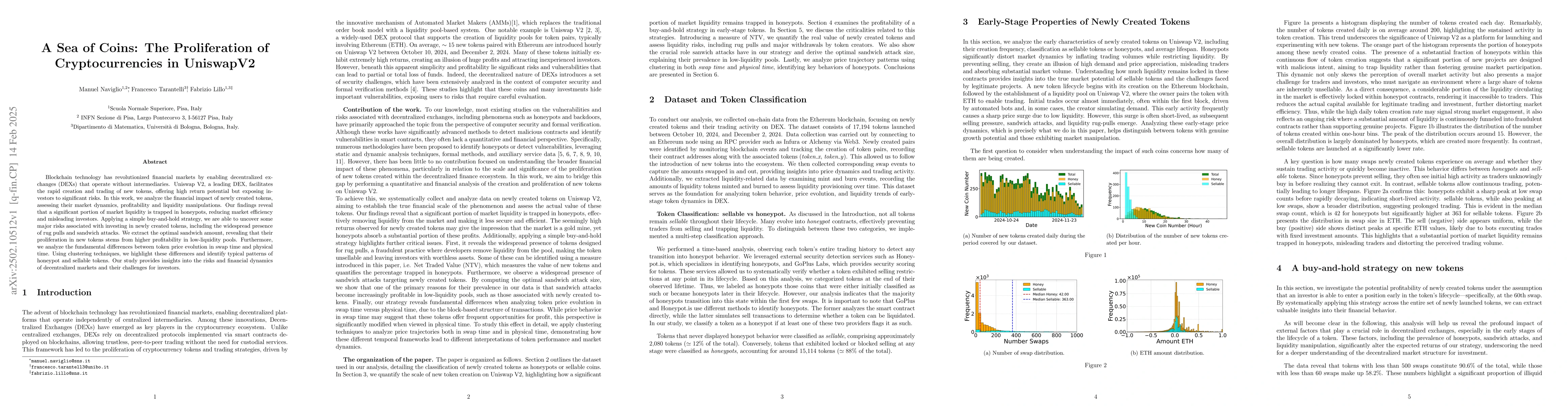

Blockchain technology has revolutionized financial markets by enabling decentralized exchanges (DEXs) that operate without intermediaries. Uniswap V2, a leading DEX, facilitates the rapid creation and trading of new tokens, offering high return potential but exposing investors to significant risks. In this work, we analyze the financial impact of newly created tokens, assessing their market dynamics, profitability and liquidity manipulations. Our findings reveal that a significant portion of market liquidity is trapped in honeypots, reducing market efficiency and misleading investors. Applying a simple buy-and-hold strategy, we are able to uncover some major risks associated with investing in newly created tokens, including the widespread presence of rug pulls and sandwich attacks. We extract the optimal sandwich amount, revealing that their proliferation in new tokens stems from higher profitability in low-liquidity pools. Furthermore, we analyze the fundamental differences between token price evolution in swap time and physical time. Using clustering techniques, we highlight these differences and identify typical patterns of honeypot and sellable tokens. Our study provides insights into the risks and financial dynamics of decentralized markets and their challenges for investors.

AI Key Findings

Generated Jun 11, 2025

Methodology

The study analyzes the financial impact of newly created tokens on UniswapV2, employing a buy-and-hold strategy to assess market dynamics, profitability, and liquidity manipulations. It quantifies the financial impact using NetTradedValue (NTV) and examines the price evolution of new tokens in swap time versus physical time, using clustering techniques to identify patterns.

Key Results

- A significant portion of market liquidity is trapped in honeypots, reducing market efficiency and misleading investors.

- The study uncovers major risks associated with investing in new tokens, including rug pulls and sandwich attacks.

- The optimal sandwich amount is extracted, revealing that their proliferation in new tokens stems from higher profitability in low-liquidity pools.

- Distinct price behavior patterns in swap time and physical time are identified, highlighting the challenges in executing trading strategies based on swap time versus real-world block time constraints.

- The research emphasizes the higher profitability of sandwich attacks in low-liquidity pools due to the diminished price impact of individual trades.

Significance

This research provides valuable insights into the risks and financial dynamics of decentralized markets, aiding investors in understanding the challenges associated with newly created tokens on UniswapV2.

Technical Contribution

The introduction of NetTradedValue (NTV) as a metric to assess the actual economic significance of new tokens within the market, along with clustering techniques to analyze price evolution in both swap time and physical time.

Novelty

This work distinguishes itself by quantifying the financial impact of new tokens using NTV, revealing the prevalence of honeypots and associated risks, and highlighting the discrepancies between swap time and physical time in decentralized markets.

Limitations

- The practical execution of the trading strategy is limited by the difficulty in precisely timing transactions within the same block due to competitive transaction ordering dynamics.

- The study does not account for all possible forms of market manipulation, as new and sophisticated techniques may emerge over time.

Future Work

- Further research could focus on developing more comprehensive methodologies to identify rug pulls at an earlier stage by analyzing smart contract characteristics before execution.

- Exploring the impact of other decentralized finance (DeFi) protocols and their unique characteristics on token liquidity and investor risks.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersProtecting Quantum Procrastinators with Signature Lifting: A Case Study in Cryptocurrencies

Or Sattath, Shai Wyborski

No citations found for this paper.

Comments (0)