Authors

Summary

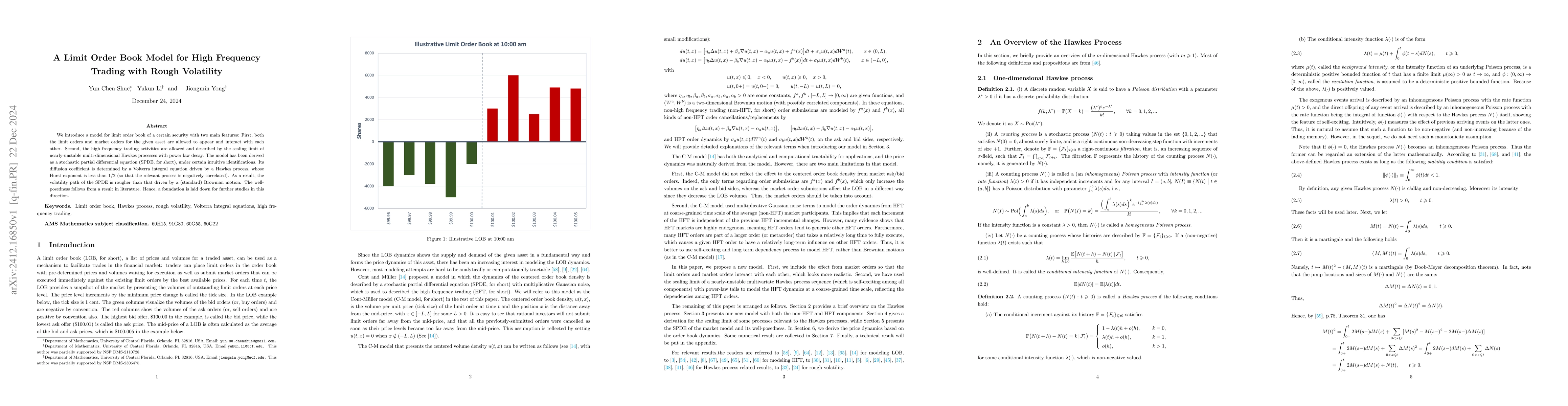

We introduce a model for limit order book of a certain security with two main features: First, both the limit orders and market orders for the given asset are allowed to appear and interact with each other. Second, the high frequency trading activities are allowed and described by the scaling limit of nearly-unstable multi-dimensional Hawkes processes with power law decay. The model has been derived as a stochastic partial differential equation (SPDE, for short), under certain intuitive identifications. Its diffusion coefficient is determined by a Volterra integral equation driven by a Hawkes process, whose Hurst exponent is less than 1/2 (so that the relevant process is negatively correlated). As a result, the volatility path of the SPDE is rougher than that driven by a (standard) Brownian motion. The well-posedness follows from a result in literature. Hence, a foundation is laid down for further studies in this direction.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersModel-based gym environments for limit order book trading

Rahul Savani, Martin Herdegen, Leandro Sanchez-Betancourt et al.

No citations found for this paper.

Comments (0)