Summary

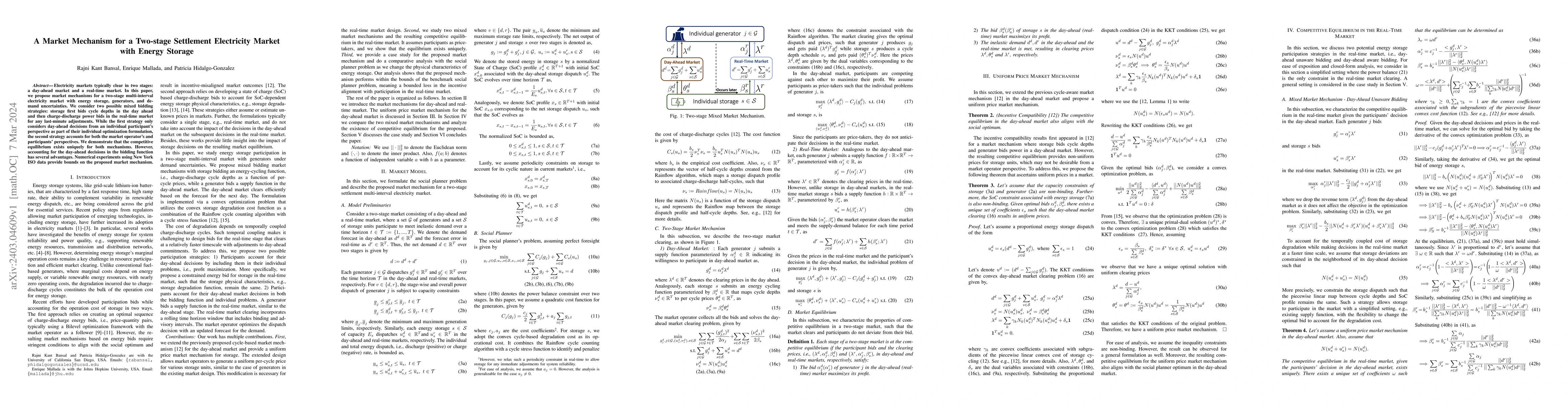

Electricity markets typically clear in two stages: a day-ahead market and a real-time market. In this paper, we propose market mechanisms for a two-stage multi-interval electricity market with energy storage, generators, and demand uncertainties. We consider two possible mixed bidding strategies: storage first bids cycle depths in the day ahead and then charge-discharge power bids in the real-time market for any last-minute adjustments. While the first strategy only considers day-ahead decisions from an individual participant's perspective as part of their individual optimization formulation, the second strategy accounts for both the market operator's and participants' perspectives. We demonstrate that the competitive equilibrium exists uniquely for both mechanisms. However, accounting for the day-ahead decisions in the bidding function has several advantages. Numerical experiments using New York ISO data provide bounds on the proposed market mechanism.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersIntercept Function and Quantity Bidding in Two-stage Electricity Market with Market Power Mitigation

Yue Chen, Pengcheng You, Enrique Mallada et al.

No citations found for this paper.

Comments (0)