Summary

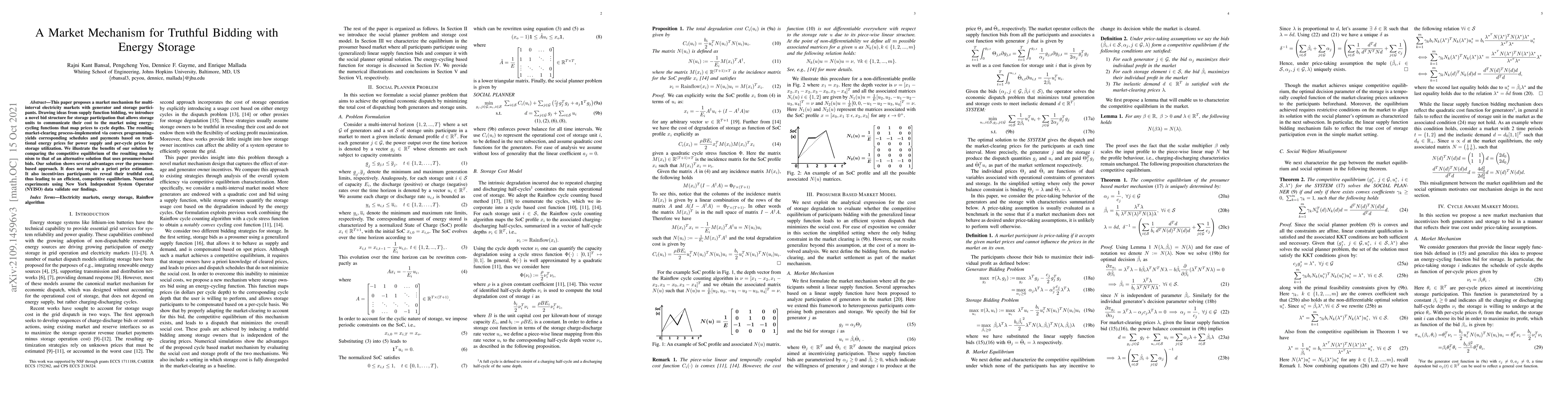

This paper proposes a market mechanism for multi-interval electricity markets with generator and storage participants. Drawing ideas from supply function bidding, we introduce a novel bid structure for storage participation that allows storage units to communicate their cost to the market using energy-cycling functions that map prices to cycle depths. The resulting market-clearing process--implemented via convex programming--yields corresponding schedules and payments based on traditional energy prices for power supply and per-cycle prices for storage utilization. We illustrate the benefits of our solution by comparing the competitive equilibrium of the resulting mechanism to that of an alternative solution that uses prosumer-based bids. Our solution shows several advantages over the prosumer-based approach. It does not require a priori price estimation. It also incentivizes participants to reveal their truthful cost, thus leading to an efficient, competitive equilibrium. Numerical experiments using New York Independent System Operator (NYISO) data validate our findings.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Market Mechanism for a Two-stage Settlement Electricity Market with Energy Storage

Patricia Hidalgo-Gonzalez, Enrique Mallada, Rajni Kant Bansal

Bidding strategies for energy storage players in 100% renewable electricity market: A game-theoretical approach

Xiufeng Liu, Arega Getaneh Abate, Dogan Keles et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)