Authors

Summary

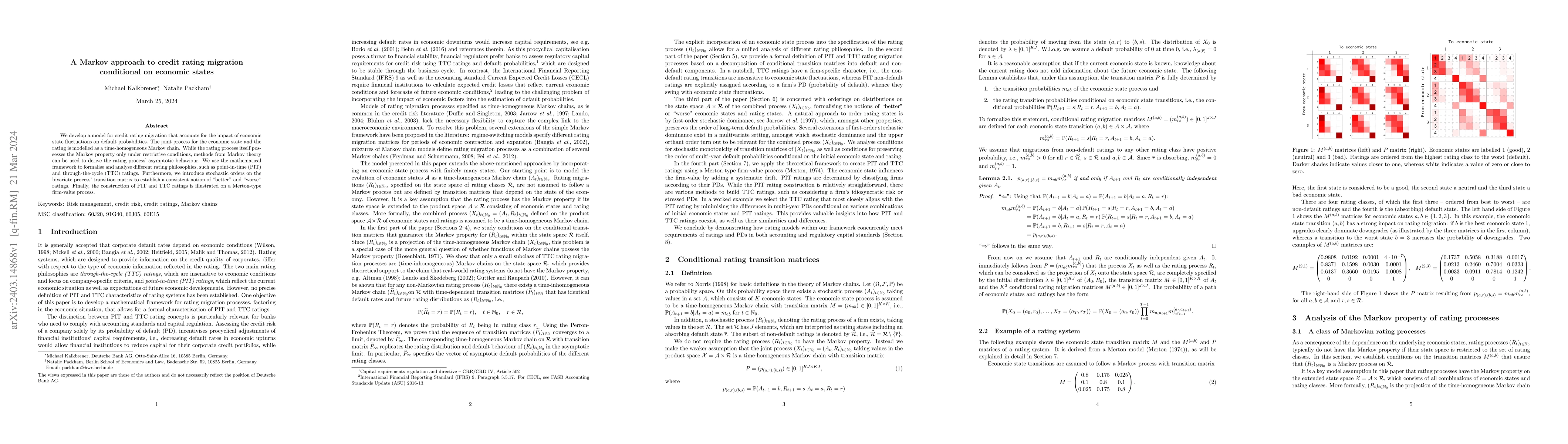

We develop a model for credit rating migration that accounts for the impact of economic state fluctuations on default probabilities. The joint process for the economic state and the rating is modelled as a time-homogeneous Markov chain. While the rating process itself possesses the Markov property only under restrictive conditions, methods from Markov theory can be used to derive the rating process' asymptotic behaviour. We use the mathematical framework to formalise and analyse different rating philosophies, such as point-in-time (PIT) and through-the-cycle (TTC) ratings. Furthermore, we introduce stochastic orders on the bivariate process' transition matrix to establish a consistent notion of "better" and "worse" ratings. Finally, the construction of PIT and TTC ratings is illustrated on a Merton-type firm-value process.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersMulti-task Envisioning Transformer-based Autoencoder for Corporate Credit Rating Migration Early Prediction

Hongfu Liu, Han Yue, Steve Xia

Impact of R&D and AI Investments on Economic Growth and Credit Rating

Davit Gondauri, Ekaterine Mikautadze

No citations found for this paper.

Comments (0)