Summary

We consider a mean field game (MFG) of optimal portfolio liquidation under asymmetric information. We prove that the solution to the MFG can be characterized in terms of a FBSDE with possibly singular terminal condition on the backward component or, equivalently, in terms of a FBSDE with finite terminal value, yet singular driver. Extending the method of continuation to linear-quadratic FBSDE with singular driver we prove that the MFG has a unique solution. Our existence and uniqueness result allows to prove that the MFG with possibly singular terminal condition can be approximated by a sequence of MFGs with finite terminal values.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

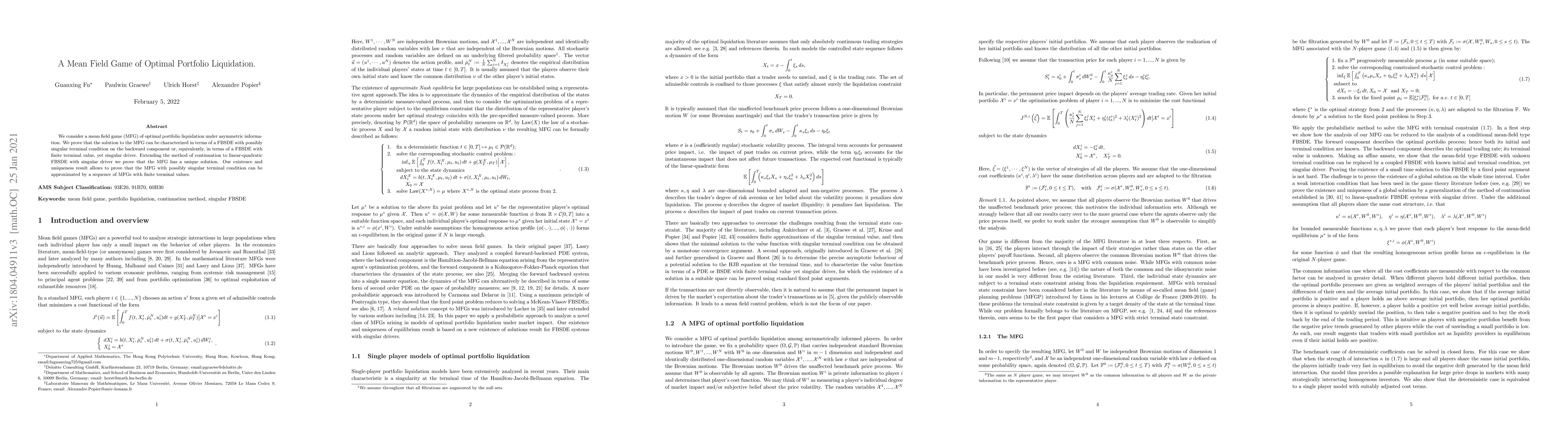

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersA Mean-Field Game of Market Entry: Portfolio Liquidation with Trading Constraints

Guanxing Fu, Paul P. Hager, Ulrich Horst

A Mean-Field Control Problem of Optimal Portfolio Liquidation with Semimartingale Strategies

Guanxing Fu, Xiaonyu Xia, Ulrich Horst

| Title | Authors | Year | Actions |

|---|

Comments (0)