Summary

In this paper, we consider the optimal portfolio liquidation problem under the dynamic mean-variance criterion and derive time-consistent solutions in three important models. We give adapted optimal strategies under a reconsidered mean-variance subject at any point in time. We get explicit trading strategies in the basic model and when random pricing signals are incorporated. When we consider stochastic liquidity and volatility, we construct a generalized HJB equation under general assumptions for the parameters. We obtain an explicit solution in stochastic volatility model with a given structure supported by empirical studies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

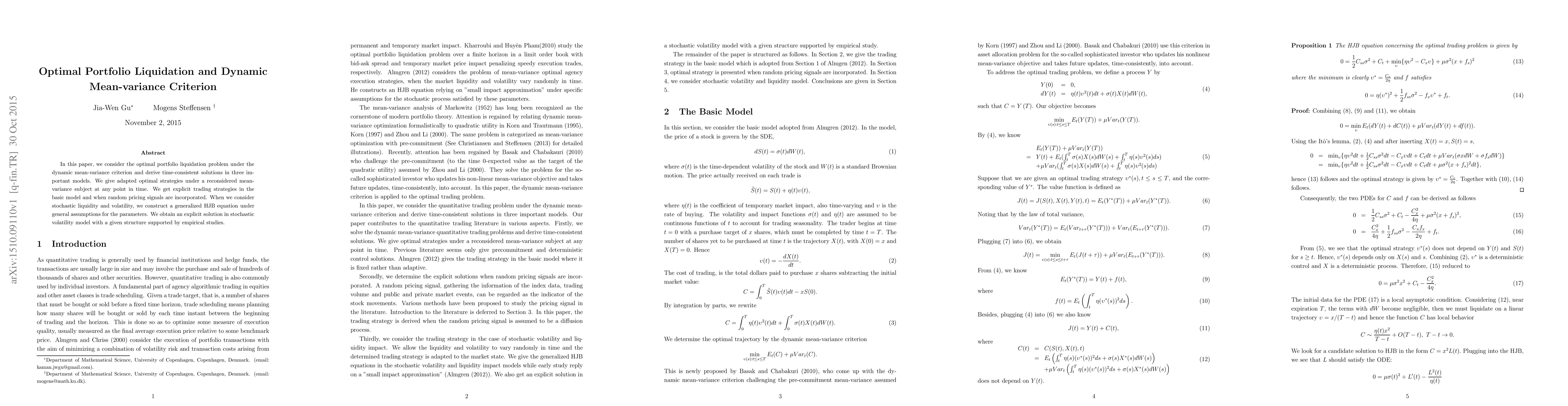

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papers| Title | Authors | Year | Actions |

|---|

Comments (0)