Authors

Summary

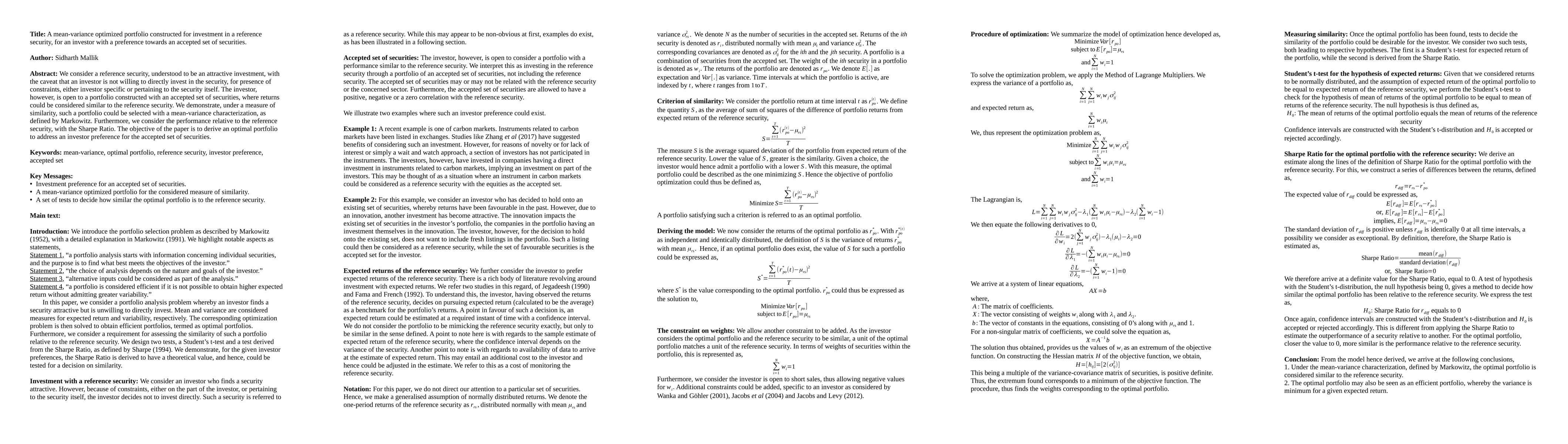

We consider a reference security, understood to be an attractive investment, with the caveat that an investor is not willing to directly invest in the security, for presence of constraints, either investor specific or pertaining to the security itself. The investor, however, is open to a portfolio constructed with an accepted set of securities, where returns could be considered similar to the reference security. We demonstrate, under a measure of similarity, such a portfolio could be selected with a mean-variance characterization, as defined by Markowitz. Furthermore, we consider the performance relative to the reference security, with the Sharpe Ratio. The objective of the paper is to derive an optimal portfolio to address an investor preference for the accepted set of securities.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersNo citations found for this paper.

Comments (0)