Summary

This paper considers a robust time-consistent mean-variance-skewness portfolio selection problem for an ambiguity-averse investor by taking into account wealth-dependent risk aversion and wealth-dependent skewness preference as well as model uncertainty. The robust equilibrium investment strategy and corresponding equilibrium value function are characterized for such a problem by employing an extended Hamilton-Jacobi-Bellman-Isaacs (HJBI) system via a game theoretic approach. Furthermore, the robust equilibrium investment strategy and corresponding equilibrium value function are obtained in semi-closed form for a special robust time-consistent mean-variance-skewness portfolio selection problem. Finally, some numerical experiments are provided to indicate several new findings concerned with the robust equilibrium investment strategy and the utility losses.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

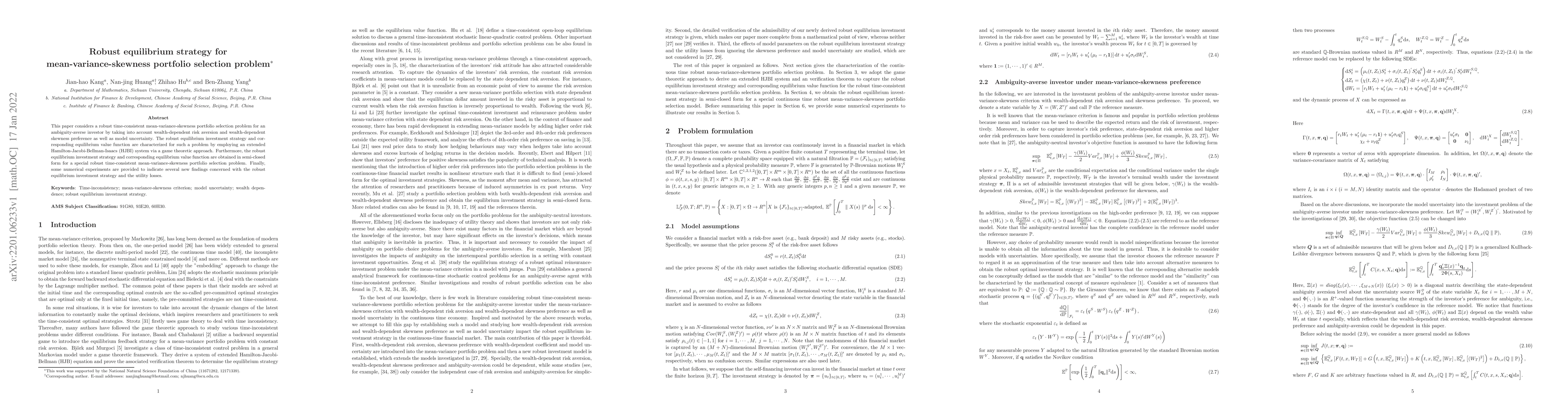

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust Equilibrium Strategy for Mean-Variance Portfolio Selection

Chao Zhou, Mengge Li, Shuaijie Qian

No citations found for this paper.

Comments (0)