Authors

Summary

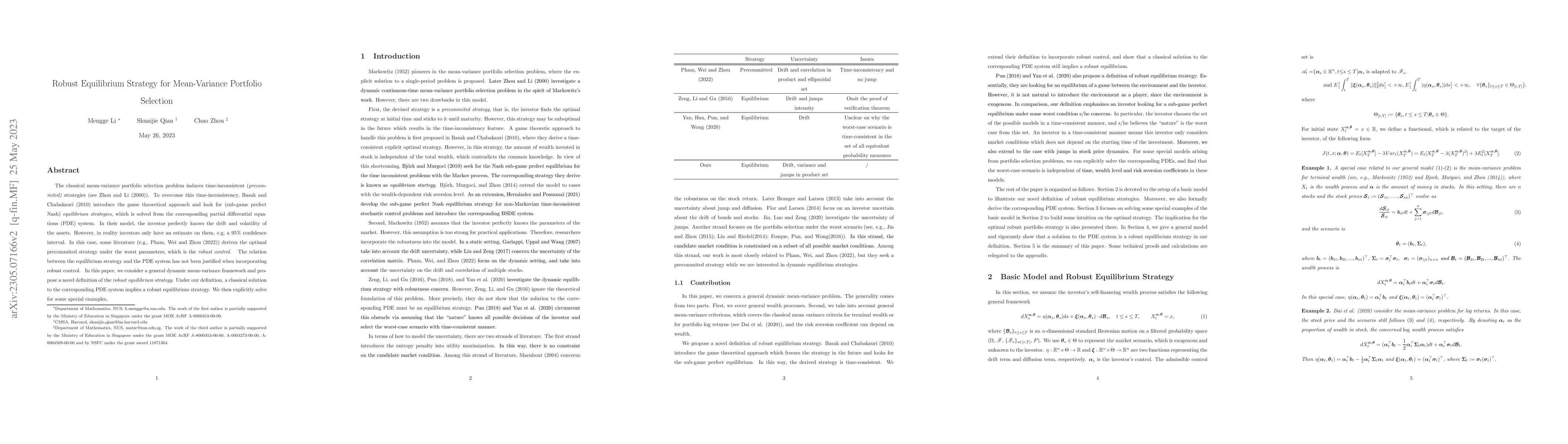

The classical mean-variance portfolio selection problem induces time-inconsistent (precommited) strategies (see Zhou and Li (2000)). To overcome this time-inconsistency, Basak and Chabakauri (2010) introduce the game theoretical approach and look for (sub-game perfect Nash) equilibrium strategies, which is solved from the corresponding partial differential equations (PDE) system. In their model, the investor perfectly knows the drift and volatility of the assets. However, in reality investors only have an estimate on them, e.g, a 95% confidence interval. In this case, some literature (e.g., Pham, Wei and Zhou (2022)) derives the optimal precommited strategy under the worst parameters, which is the robust control. The relation between the equilibrium strategy and the PDE system has not been justified when incorporating robust control. In this paper, we consider a general dynamic mean-variance framework and propose a novel definition of the robust equilibrium strategy. Under our definition, a classical solution to the corresponding PDE system implies a robust equilibrium strategy. We then explicitly solve for some special examples.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

No citations found for this paper.

Comments (0)