Summary

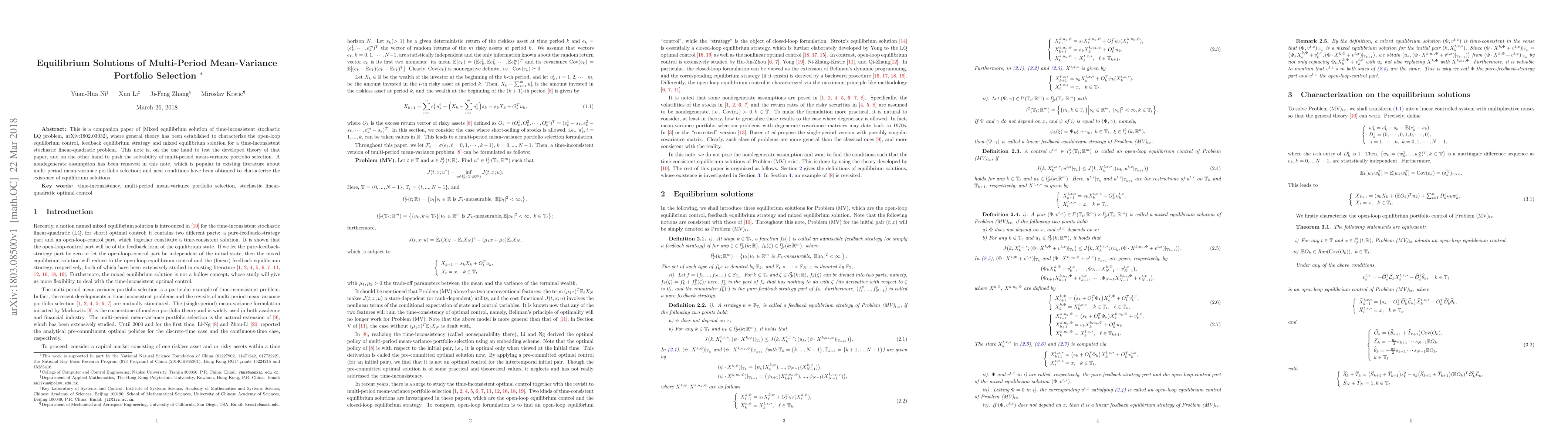

This is a companion paper of [Mixed equilibrium solution of time-inconsistent stochastic LQ problem, arXiv:1802.03032], where general theory has been established to characterize the open-loop equilibrium control, feedback equilibrium strategy and mixed equilibrium solution for a time-inconsistent stochastic linear-quadratic problem. This note is, on the one hand to test the developed theory of that paper, and on the other hand to push the solvability of multi-period mean-variance portfolio selection. A nondegenerate assumption has been removed in this note, which is popular in existing literature about multi-period mean-variance portfolio selection; and neat conditions have been obtained to characterize the existence of equilibrium solutions.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersBayesian Filtering for Multi-period Mean-Variance Portfolio Selection

Rituparna Sen, Shubhangi Sikaria, Neelesh S. Upadhye

Robust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

Robust Equilibrium Strategy for Mean-Variance Portfolio Selection

Chao Zhou, Mengge Li, Shuaijie Qian

| Title | Authors | Year | Actions |

|---|

Comments (0)