Authors

Summary

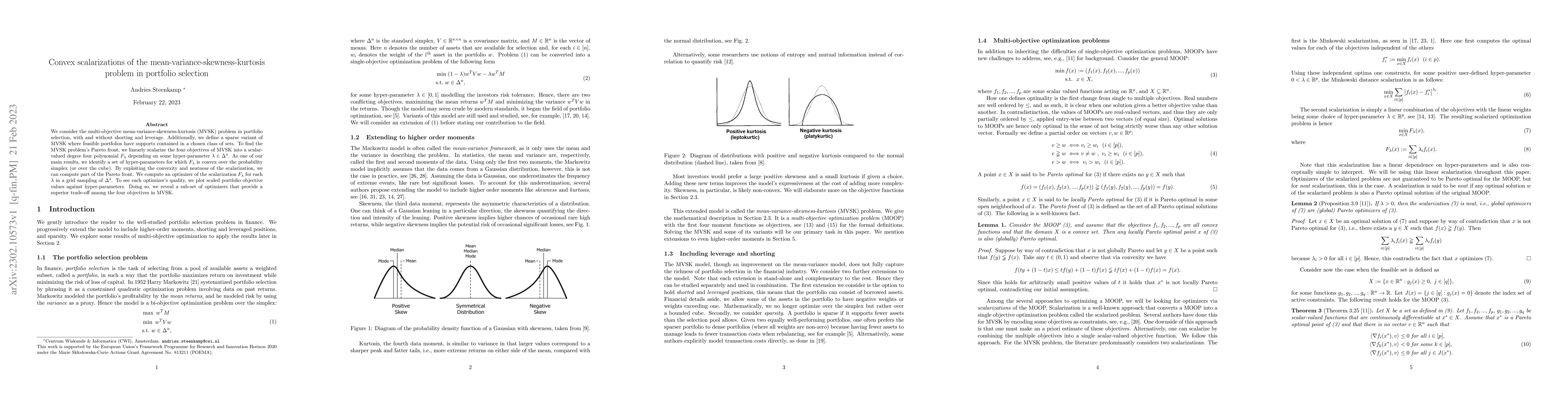

We consider the multi-objective mean-variance-skewness-kurtosis (MVSK) problem in portfolio selection, with and without shorting and leverage. Additionally, we define a sparse variant of MVSK where feasible portfolios have supports contained in a chosen class of sets. To find the MVSK problem's Pareto front, we linearly scalarize the four objectives of MVSK into a scalar-valued degree four polynomial $F_{\lambda}$ depending on some hyper-parameter $\lambda \in \Delta^4$. As one of our main results, we identify a set of hyper-parameters for which $F_{\lambda}$ is convex over the probability simplex (or over the cube). By exploiting the convexity and neatness of the scalarization, we can compute part of the Pareto front. We compute an optimizer of the scalarization $F_{\lambda}$ for each $\lambda$ in a grid sampling of $\Delta^4$. To see each optimizer's quality, we plot scaled portfolio objective values against hyper-parameters. Doing so, we reveal a sub-set of optimizers that provide a superior trade-off among the four objectives in MVSK.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersRobust equilibrium strategy for mean-variance-skewness portfolio selection problem

Zhihao Hu, Nan-jing Huang, Jian-hao Kang et al.

No citations found for this paper.

Comments (0)