Summary

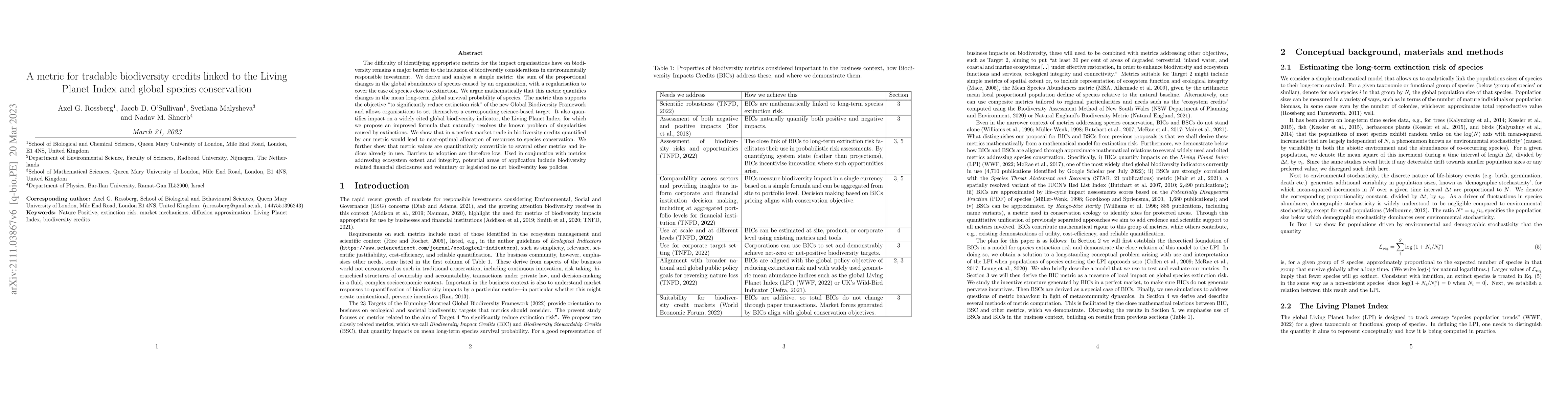

Difficulties identifying appropriate biodiversity impact metrics remain a major barrier to inclusion of biodiversity considerations in environmentally responsible investment. We propose and analyse a simple science-based local metric: the sum of proportional changes in local species abundances relative to their global species abundances, with a correction for species close to extinction. As we show, this metric quantifies changes in the mean long-term global survival probability of species. It links mathematically to a widely cited global biodiversity indicator, the Living Planet Index, for which we propose an improved formula that directly addresses the known problem of singularities caused by extinctions. We show that, in an ideal market, trade in our metric would lead to near-optimal allocation of resources to species conservation. We further show that the metric is closely related to several other metrics and indices already in use. Barriers to adoption are therefore low. Used in conjunction with metrics addressing ecosystem functioning and services, potential areas of application include biodiversity related financial disclosures and voluntary or legislated no net biodiversity loss policies.

AI Key Findings

Get AI-generated insights about this paper's methodology, results, and significance.

Paper Details

PDF Preview

Key Terms

Citation Network

Current paper (gray), citations (green), references (blue)

Display is limited for performance on very large graphs.

Similar Papers

Found 4 papersUnlocking the Forgotten Dimension of Biodiversity: A Scalable Genetic Diversity Index for Multi-Species Analysis

Rose, L., Karunarathne, P., Kluempen, M.

Spatial Biodiversity Indicators and a Composite Index for Conservation Prioritization in Switzerland

M.-A., Gross, A., Adde, A. et al.

Market Design for Tradable Mobility Credits

Siyu Chen, Andrea Araldo, Yu Jiang et al.

| Title | Authors | Year | Actions |

|---|

Comments (0)